|

| 1 |  |

The very long run is a theoretical time frame over which the firm can vary: |

|  | A) | labor and capital, but not technology |

|  | B) | all input levels and technology but cannot introduce new products |

|  | C) | technology and introduce new products but cannot vary input levels |

|  | D) | all input levels and technology, as well as introduce new products |

|

|

|

| 2 |  |

The inverted-U theory suggests that R&D expenditures first rise, reach a peak, and then fall as the profitability of the firm increases. |

|  | A) | True |

|  | B) | False |

|

|

|

| 3 |  |

Expenditures on research and development include all the following activities, except: |

|  | A) | creative destruction |

|  | B) | innovation |

|  | C) | diffusion |

|  | D) | invention |

|

|

|

| 4 |  |

A firm anticipates that a particular R&D expenditure of $40 million will generate a one-time profit of $43 million one year later. The firm will undertake this expenditure if its interest-rate-cost of borrowing is: |

|  | A) | at least 8% |

|  | B) | at least 10% |

|  | C) | at most 3% |

|  | D) | at most 7.5% |

|

|

|

| 5 |  |

Benchmark Capital provided $6.5 million in start-up funds to internet auction site eBay in exchange for shares of stock in the company. These funds are known as: |

|  | A) | venture capital |

|  | B) | preferred shares |

|  | C) | mutual funds |

|  | D) | dividends |

|

|

|

| 6 |  |

In the three-step process of technological advance, diffusion refers to: |

|  | A) | a firm's ability to successfully market the product to other countries |

|  | B) | a firm's ability to spread the overhead and startup costs to other divisions within the firm |

|  | C) | the end of the product's useful cycle, when newer, more advanced products begin to take its place |

|  | D) | wide imitation and spread of an innovation |

|

|

|

| 7 |  |

Which of the following market characteristics suggests that purely competitive firms have only weak incentives to innovate? |

|  | A) | Freedom of new firms to enter the industry |

|  | B) | Highly differentiated products |

|  | C) | Economies of scale |

|  | D) | Zero profits in the short run |

|

|

|

| 8 |  |

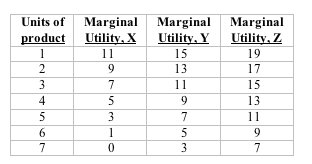

Use the following table to answer the next question.

<a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/1113273090/384259/quiz24a_8.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (13.0K)</a> <a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/1113273090/384259/quiz24a_8.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (13.0K)</a>

Refer to the above data. The firm's optimal amount of R&D spending is: |

|  | A) | $20 million |

|  | B) | $30 million |

|  | C) | $40 million |

|  | D) | $50 million |

|

|

|

| 9 |  |

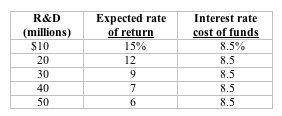

Use the following table to answer the next question.

<a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/1113273090/384259/quiz24b_9.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (9.0K)</a> <a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/1113273090/384259/quiz24b_9.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (9.0K)</a>

Refer to the above data. At the $20 million level of R&D expenditures, the: |

|  | A) | marginal benefit of R&D exceeds the marginal cost |

|  | B) | marginal cost of R&D exceeds the marginal benefit |

|  | C) | the firm is maximizing its total return on R&D |

|  | D) | the firm would need to borrow outside funds (bonds or venture capital) to expand its R&D expenditures |

|

|

|

| 10 |  |

With respect to R&D expenditures, the expected rate of return curve illustrates: |

|  | A) | only those expenditures that are profitable, whether affordable or not |

|  | B) | the total benefit of each dollar of expenditure |

|  | C) | the marginal benefit of each dollar of expenditure |

|  | D) | the average benefit of each dollar of expenditure |

|

|