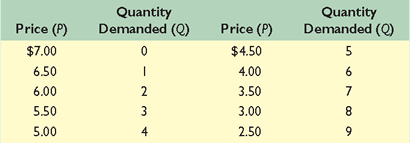

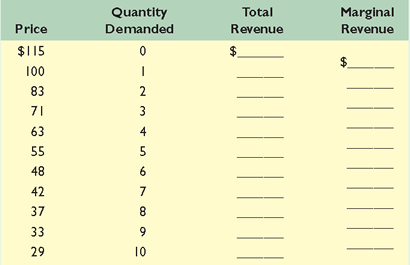

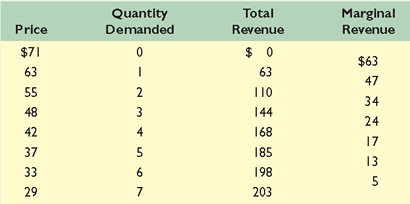

Economics (McConnell), 18th EditionChapter 10: Pure MonopolyKey Questions1. Use the demand schedule to the upper right to calculate total revenue and marginal revenue at each quantity. Plot the demand, total-revenue, and marginal-revenue curves and explain the relationships between them. Explain why the marginal revenue of the fourth unit of output is $3.50, even though its price is $5.00. Use Chapter 6's total-revenue test for price elasticity to designate the elastic and inelastic segments of your graphed demand curve. What generalization can you make as to the relationship between marginal revenue and elasticity of demand? Suppose the marginal cost of successive units of output was zero. What output would the profit-seeking firm produce? Finally, use your analysis to explain why a monopolist would never produce in the inelastic region of demand.  2. Suppose a pure monopolist is faced with the demand schedule shown below and the same cost data as the competitive producer discussed in question 4 at the end of Chapter 9. Calculate the missing total-revenue and marginal-revenue amounts, and determine the profit-maximizing price and profit-earning output for this monopolist. What is the monopolist's profit? Verify your answer graphically and by comparing total revenue and total cost.  3. Suppose that a price-discriminating monopolist has segregated its market into two groups of buyers, the first group described by the demand and revenue data that you developed for question 5. The demand and revenue data for the second group of buyers is shown in the accompanying table. Assume that MC is $13 in both markets and MC = ATC at all output levels. What price will the firm charge in each market? Based solely on these two prices, what can you conclude about the relative elasticities of demand in the two markets? What will be this monopolist's total economic profit?  4. It has been proposed that natural monopolists should be allowed to determine their profit-maximizing outputs and prices and then government should tax their profits away and distribute them to consumers in proportion to their purchases from the monopoly. Is this proposal as socially desirable as requiring monopolists to equate price with marginal cost or average total cost? |  |