|

| 1 |  |

The process of management involves which of the following? |

|  | A) | Planning |

|  | B) | Controlling |

|  | C) | Decision making |

|  | D) | All of the above |

|

|

|

| 2 |  |

The sacrifice made, usually measured by the resources given up, to achieve a particular purpose is called which of the following? |

|  | A) | A cost |

|  | B) | An expense |

|  | C) | A product cost |

|  | D) | An inventoriable cost |

|

|

|

| 3 |  |

Which of the following is an example of a period cost? |

|  | A) | Direct materials cost |

|  | B) | Direct-labor cost |

|  | C) | Monthly office rent |

|  | D) | Indirect labor |

|

|

|

| 4 |  |

Which of the following is an inventoriable cost? |

|  | A) | Direct-labor cost |

|  | B) | Direct material cost |

|  | C) | Manufacturing overhead cost |

|  | D) | all of the above |

|

|

|

| 5 |  |

Which of the following is a period cost? |

|  | A) | Research and development costs |

|  | B) | Direct-labor cost |

|  | C) | Direct material cost |

|  | D) | Indirect labor cost |

|

|

|

| 6 |  |

Which of the following is false? |

|  | A) | Product cost for merchandise is the cost of purchases plus transportation. |

|  | B) | Cost of merchandise sold is also called the cost of goods sold. |

|  | C) | Retailers and wholesalers treat period costs as expenses. |

|  | D) | Period costs are treated as product costs with service industry firms |

|

|

|

| 7 |  |

A manufacturer has how many inventories? |

|  | A) | One |

|  | B) | Two |

|  | C) | Three |

|  | D) | Four |

|

|

|

| 8 |  |

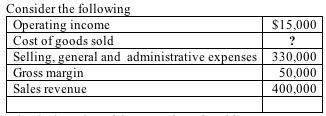

<a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0070667705/388288/ch02_08.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (13.0K)</a> <a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0070667705/388288/ch02_08.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (13.0K)</a>

What is the value of the cost of goods sold? |

|  | A) | $250,000 |

|  | B) | $300,000 |

|  | C) | $350,000 |

|  | D) | $400,000 |

|

|

|

| 9 |  |

Which of the following accounts represent materials before they are placed into production? |

|  | A) | Finished-goods |

|  | B) | Work-in-process |

|  | C) | Raw-material |

|  | D) | Purchases |

|

|

|

| 10 |  |

Which of the following accounts represent manufactured products that are only partially completed at the date of the balance sheet? |

|  | A) | Finished-goods |

|  | B) | Work-in-process |

|  | C) | Raw-material |

|  | D) | Purchases |

|

|

|

| 11 |  |

Which of the following production processes is described as a process having low production volume, little standardization, and one-of-a-kind products? |

|  | A) | Batch |

|  | B) | Assemble line |

|  | C) | Mass customization |

|  | D) | Job-shop |

|

|

|

| 12 |  |

Which of the following production processes is described as a process with multiple products and low volume? |

|  | A) | Batch |

|  | B) | Assembly line |

|  | C) | Mass customization |

|  | D) | Continuous flow |

|

|

|

| 13 |  |

Which of the following production processes is described as process with few major products and higher volume than batch processing? |

|  | A) | Batch |

|  | B) | Assembly line |

|  | C) | Mass customization |

|  | D) | Continuous flow |

|

|

|

| 14 |  |

Which of the following production processes is described as a production process with high production volume, and with many standardized components and/or customized combination of components? |

|  | A) | Batch |

|  | B) | Assembly line |

|  | C) | Mass customization |

|  | D) | Continuous flow |

|

|

|

| 15 |  |

Which of the following production processes is described as a process with high production volume and highly standardized commodity products? |

|  | A) | Batch |

|  | B) | Assembly line |

|  | C) | Mass customization |

|  | D) | Continuous flow |

|

|

|

| 16 |  |

Which of the following is not a manufacturing overhead cost? |

|  | A) | Direct materials |

|  | B) | Overtime premiums |

|  | C) | Indirect materials |

|  | D) | Indirect labor |

|

|

|

| 17 |  |

Which of the following costs is a manufacturing overhead cost? |

|  | A) | Property taxes on the factory |

|  | B) | Depreciation of plant and equipment |

|  | C) | Service department costs |

|  | D) | All of the above |

|

|

|

| 18 |  |

Which of the following costs is a conversion cost? |

|  | A) | Direct materials |

|  | B) | Office management |

|  | C) | Factory rent |

|  | D) | Only (B) and (C) |

|

|

|

| 19 |  |

Employee #124 normally works a 40-hour week at $15 per hour. In Week 5, employee #124 worked 48 hours, which included idle time of 3 hours. Overtime is paid at 1.5 times the regular hourly rate. What is the amount of the overtime premium? |

|  | A) | $120 |

|  | B) | $60 |

|  | C) | $720 |

|  | D) | $780 |

|

|

|

| 20 |  |

Employee #124 normally works a 40-hour week at $18 per hour. In week 5, employee #124 worked 47 hours, which included idle time of 3 hours due to an electrical outage. Overtime is paid at 1.5 times the regular hourly rate. What is the amount of the employee's wages that should be classified as manufacturing overhead costs? |

|  | A) | $117 |

|  | B) | $63 |

|  | C) | $54 |

|  | D) | $720 |

|

|

|

| 21 |  |

Which of the following is true? |

|  | A) | Both raw-material and direct material are used to classify material not yet placed into production. |

|  | B) | Raw-materials and direct materials are synonymous classifications of materials. |

|  | C) | Material that can be conveniently traced to products is called direct material. |

|  | D) | Materials that are an integral part of a finished product may be classified as indirect material. |

|

|

|

| 22 |  |

The total of which pair of costs make up prime costs? |

|  | A) | Direct material and manufacturing overhead |

|  | B) | Direct material and direct labor |

|  | C) | Indirect material and indirect labor |

|  | D) | Direct labor and manufacturing overhead |

|

|

|

| 23 |  |

<a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0070667705/388288/ch02_23.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (13.0K)</a> <a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0070667705/388288/ch02_23.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (13.0K)</a>

What is the value of the ending work-in-process inventory? |

|  | A) | $65,000 |

|  | B) | $35,000 |

|  | C) | $50,000 |

|  | D) | $70,000 |

|

|

|

| 24 |  |

<a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0070667705/388288/ch02_24.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (16.0K)</a> <a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0070667705/388288/ch02_24.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (16.0K)</a>

What was the amount of the ending raw-material inventoy? |

|  | A) | $55,000 |

|  | B) | $65,000 |

|  | C) | $15,000 |

|  | D) | $100,000 |

|

|

|

| 25 |  |

<a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0070667705/388288/ch02_25.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (15.0K)</a> <a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0070667705/388288/ch02_25.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (15.0K)</a>

What is the total manufacturing overhead? |

|  | A) | $690,000 |

|  | B) | $400,000 |

|  | C) | $350,000 |

|  | D) | $360,000 |

|

|

|

| 26 |  |

<a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0070667705/388288/ch02_26.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (10.0K)</a> <a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0070667705/388288/ch02_26.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (10.0K)</a>

What was the ending finished goods inventory? |

|  | A) | $100,000 |

|  | B) | $140,000 |

|  | C) | $60,000 |

|  | D) | $160,000 |

|

|

|

| 27 |  |

Which of the following is one of the most important when determining the classification of a cost? |

|  | A) | When the cost is recognized. |

|  | B) | The way a cost changes in relation to changes in activity levels. |

|  | C) | The time period in which the cost is incurred. |

|  | D) | The significance of the cost. |

|

|

|

| 28 |  |

A characteristic of an activity or event that causes costs to be incurred by that activity or event is called which of the following? |

|  | A) | A cost driver |

|  | B) | An out-of-pocket cost |

|  | C) | A variable cost |

|  | D) | A marginal cost |

|

|

|

| 29 |  |

<a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0070667705/388288/ch02_29.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (18.0K)</a> <a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0070667705/388288/ch02_29.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (18.0K)</a>

Which of the costs, A, B, or C, is a variable cost? |

|  | A) | Cost A |

|  | B) | Cost B |

|  | C) | Cost C |

|  | D) | Cost A and C |

|

|

|

| 30 |  |

Which of the following refers to a cost that can be substantially influenced by a manager? |

|  | A) | Sunk cost. |

|  | B) | Direct cost. |

|  | C) | Opportunity cost. |

|  | D) | Controllable cost. |

|

|

|

| 31 |  |

Which of the following refers to a cost that has been incurred in the past and cannot be altered by any current or future action? |

|  | A) | Sunk cost. |

|  | B) | Direct cost. |

|  | C) | Opportunity cost. |

|  | D) | Controllable cost. |

|

|

|

| 32 |  |

Which of the following refers to a cost that is a benefit sacrificed when the choice of one action precludes taking an alternative course of action? |

|  | A) | Out-of-pocket cost. |

|  | B) | Direct cost. |

|  | C) | Opportunity cost. |

|  | D) | Controllable cost. |

|

|

|

| 33 |  |

Which of the following refers to the difference in a cost item between two decision alternatives? |

|  | A) | Out-of-pocket cost. |

|  | B) | Direct cost. |

|  | C) | Differential cost. |

|  | D) | Controllable cost. |

|

|

|

| 34 |  |

<a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0070667705/388288/ch02_34.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (13.0K)</a> <a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0070667705/388288/ch02_34.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (13.0K)</a>

You have been offered an $800 trade-in allowance on the purchase of a different automobile that is priced at $10,500. If you decide to make the trade-in and purchase the new car, which of the following will occur? |

|  | A) | You will lose $310. |

|  | B) | You will lose $1,110. |

|  | C) | You will gain $310. |

|  | D) | The amount you paid to refurbish you old car is irrelevant to the decision. |

|

|

|

| 35 |  |

Which of the following refers to costs that require the payment of cash or other assets as a result of their incurrence? |

|  | A) | Out-of-pocket cost. |

|  | B) | Direct cost. |

|  | C) | Differential cost. |

|  | D) | Controllable cost. |

|

|

|

| 36 |  |

<a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0070667705/388288/ch02_36.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (9.0K)</a> <a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0070667705/388288/ch02_36.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (9.0K)</a>

What is the marginal cost of the fourth computer? |

|  | A) | $5,000 |

|  | B) | $1,250 |

|  | C) | $1,000 |

|  | D) | $1,200 |

|

|

|

| 37 |  |

<a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0070667705/388288/ch02_37.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (10.0K)</a> <a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0070667705/388288/ch02_37.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (10.0K)</a>

What is the average cost per unit? |

|  | A) | $1,000 |

|  | B) | $1,250 |

|  | C) | $1,125 |

|  | D) | $1,750 |

|

|

|

| 38 |  |

In a print shop that does customized printing for several clients, the salary of the manager of the print shop is most likely classified as which of the following? |

|  | A) | Direct cost |

|  | B) | Variable cost |

|  | C) | Indirect cost |

|  | D) | Product cost |

|

|

|

| 39 |  |

In a print shop that does customized printing for several clients, the cost of paper is most likely classified as which of the following? |

|  | A) | Product cost |

|  | B) | Direct cost |

|  | C) | Variable cost |

|  | D) | All of the above |

|

|

|

| 40 |  |

Management of a print shop should consider which of the following in a decision to discard printing equipment used in customized print jobs and purchase printing equipment that will provide the ability to increase the number of printed advertising flyers? |

|  | A) | Sunk costs |

|  | B) | Opportunity costs |

|  | C) | Out-of-pocket costs |

|  | D) | B and C only. |

|

|