Define accounting.

Briefly distinguish financial accounting from managerial accounting.

The accounting process generates financial reports for both internal and external users. Identify some of the groups of users.

Briefly distinguish investors from creditors.

What is an accounting entity? Why is a business treated as a separate entity for accounting purposes?

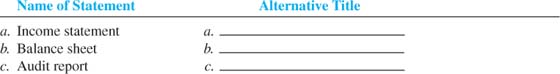

Complete the following:

<a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0073324833/pg29_1.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (K)</a>

<a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0073324833/pg29_1.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (K)</a>

What information should be included in the heading of each of the four primary financial statements?

What are the purposes of (a) the income statement, (b) the balance sheet, (c) the statement of cash flows, and (d) the statement of retained earnings?

Explain why the income statement and the statement of cash flows are dated “For the Year Ended December 31, 2008,” whereas the balance sheet is dated “At December 31, 2008.”

Briefly explain the importance of assets and liabilities to the decisions of investors and creditors.

Briefly define net income and net loss.

Explain the accounting equation for the income statement. What are the three major items reported on the income statement?

Explain the accounting equation for the balance sheet. Define the three major components reported on the balance sheet.

Explain the accounting equation for the statement of cash flows. Explain the three major components reported on the statement.

Explain the accounting equation for the statement of retained earnings. Explain the four major items reported on the statement of retained earnings.

Financial statements discussed in this chapter are aimed at external users. Briefly explain how a company's internal managers in different functional areas (e.g., marketing, purchasing, human resources) might use financial statement information from their own and other companies.

Briefly describe the way that accounting measurement rules (generally accepted accounting principles) are determined in the United States.

Briefly explain the responsibility of company management and the independent auditors in the accounting communication process.

(Supplement A) Briefly differentiate between a sole proprietorship, a partnership, and a corporation.

(Supplement B) List and briefly explain the three primary services that CPAs in public practice provide.