Download as a Word document:  Hands-On Exercises Ch06 (214.0K) Hands-On Exercises Ch06 (214.0K) Sunny Side Marina-Five Year Projected Financial

Statement In this exercise you will practice entering formulas and

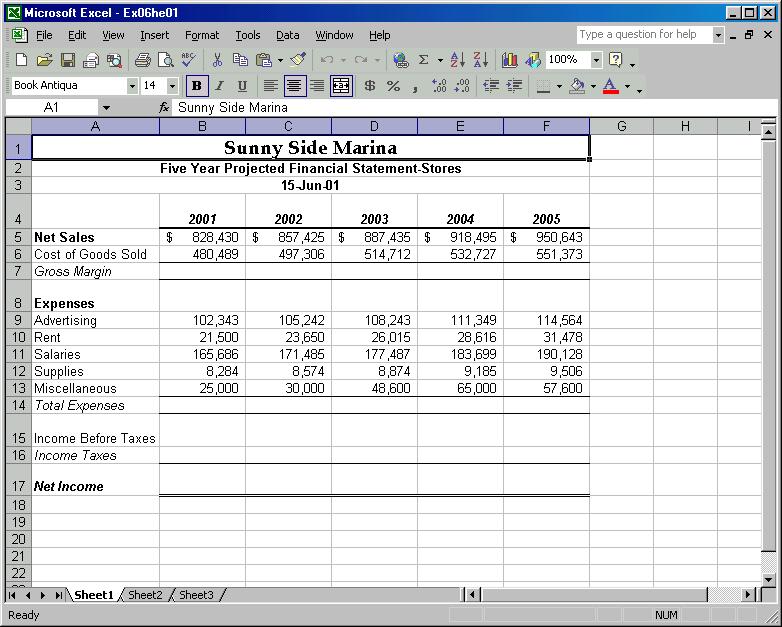

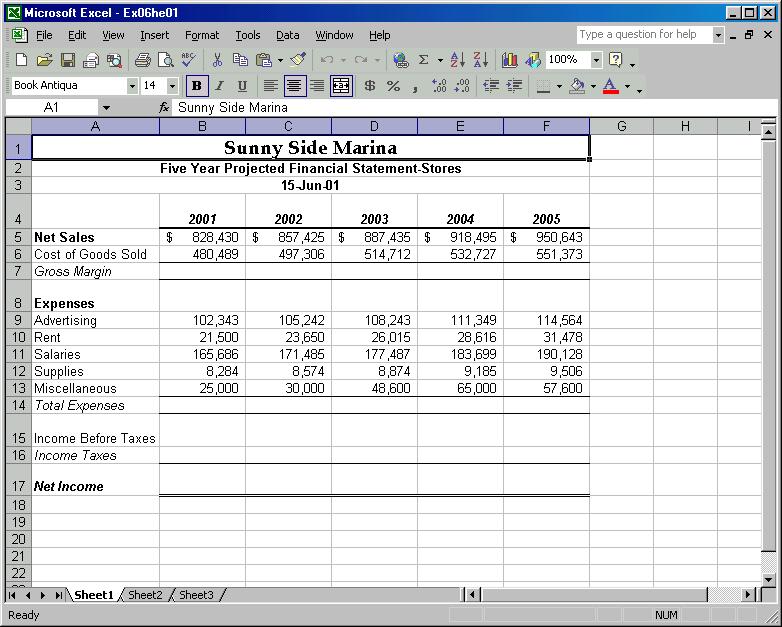

functions. - Open the data file named EX06HE01. You screen should look

similar to Figure 6-1.

<a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg:: ::/sites/dl/free/0072470941/26807/Ch06_Image1ho.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (50.0K)</a> <a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg:: ::/sites/dl/free/0072470941/26807/Ch06_Image1ho.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (50.0K)</a>

Figure 6-1 - Save the file as "Five Year Plan" to your personal

storage location.

- There are a number of formulas to enter for starters. To

begin:

CLICK: Cell B7

TYPE: =B5-B6

PRESS: Enter - Fill the formula across the remaining columns.

SELECT: Cells B7 to F7

CLICK: Edit, Fill, Right - Now you will total the Expenses for each year using the

SUM Function:

SELECT: Cells B14 to F14

CLICK: AutoSum Button on the Standard tool bar. - To calculate the Income before taxes:

SELECT: Cell B15

TYPE: = (Equals)

SELECT: Cell B7

TYPE: - (minus)

CLICK: B14

PRESS: Enter - To fill the formula across, using the fill handle:

SELECT: Cell B15

CLICK: Fill handle, and hold the mouse key down

DRAG: To highlight row 15 over to column F

Notice that the last two columns numbers are in parenthesis.

What is the reason for this? - Since the company doesn’t pay taxes when income is

less than zero, you will use the IF function to determine

when to calculate the tax.

SELECT: Cell B16

CLICK: the Insert function button

SELECT: the IF function,

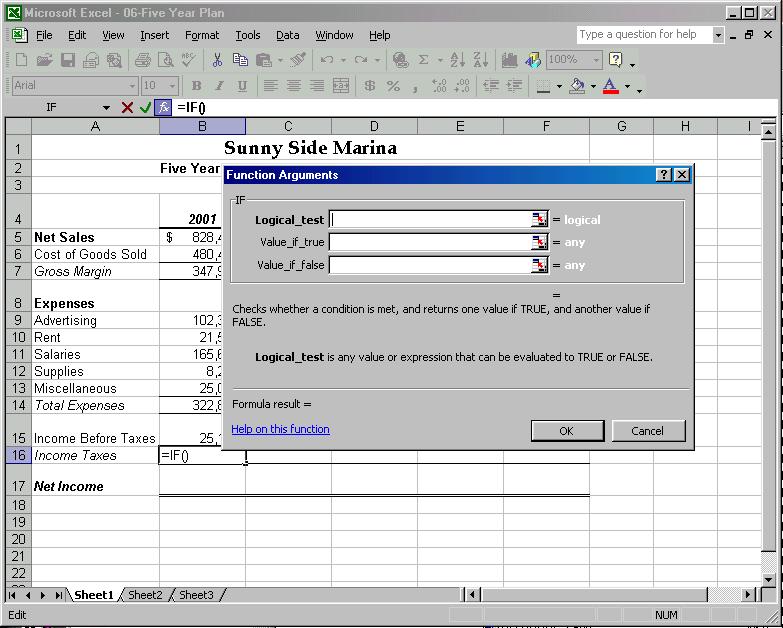

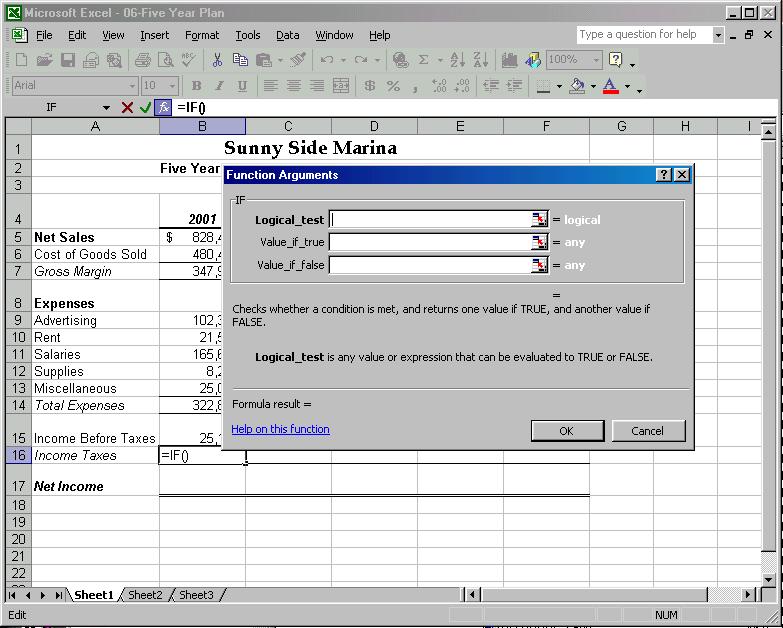

CLICK: OK - The functions arguments dialog box opens (Figure 6-2) to

allow you to specify the arguments for this calculation. To

perform the calculation, you need to test if the value for

Income Before Taxes is greater than zero, if it is the tax

rate is a fixed 48%, if the value is less than or equal to

zero, then the Income Tax is 0. To begin:

TYPE: b15>0

PRESS: Tab

TYPE: b15*48%

PRESS: Tab

TYPE: 0

CLICK: OK  <a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg:: ::/sites/dl/free/0072470941/26807/Ch06_Image2ho.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (50.0K)</a> <a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg:: ::/sites/dl/free/0072470941/26807/Ch06_Image2ho.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (50.0K)</a>

Figure 6-2 - On your own, fill the formula you just created across to

column F. Notice that the last two columns are displaying a

"-." What is the reason for this?

- The final calculation subtracts the Income taxes

from

Income Before Taxes. On your own enter this formula and fill

it across the columns. Format the cells by decreasing the

decimals to match the other values in the worksheet.

- When you are finished, save your work, and print the

worksheet. Finally, close the file and exit Excel.

Data File:  EX06HE01 (14.0K) EX06HE01 (14.0K)

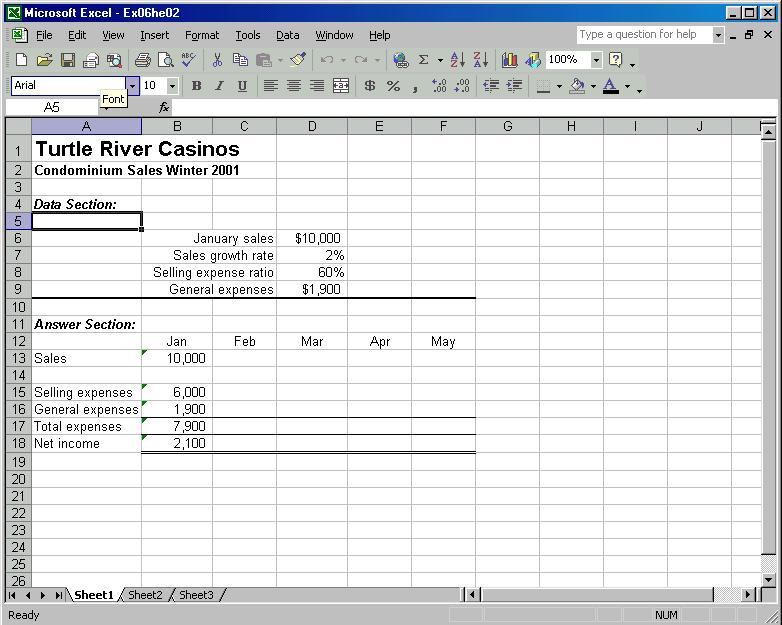

Turtle River Casino-Condominium Sales In addition to the casino facilities, Turtle River Casinos

also sells time-share condominiums. In this exercise you will

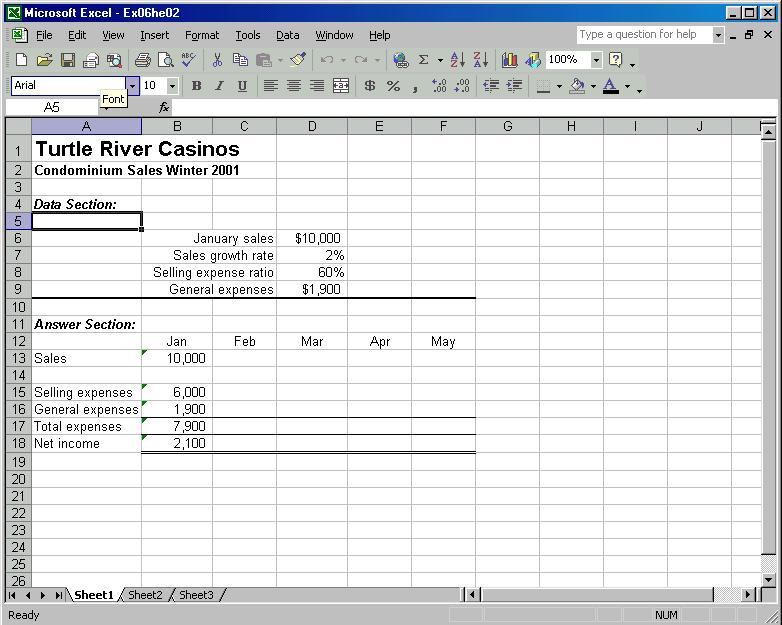

practice using and entering if functions. - Open the data file named "EX06HE02." Your screen should

look similar to Figure 6-3.

<a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg:: ::/sites/dl/free/0072470941/26807/Ch06_Image3ho.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (50.0K)</a> <a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg:: ::/sites/dl/free/0072470941/26807/Ch06_Image3ho.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (50.0K)</a>

Figure 6-3 - Save the workbook as "Condo Sales" to your personal

storage location.

- There are some formulas already entered in Column B, in

rows 13 and 15 to18. review the formulas to familiarize

yourself with the calculations. However, the ones you will be

using are slightly different. To make the formulas easier to

enter, you start by naming the ranges in the data section:

SELECT: Cell D6

CLICK: Name text box

TYPE: Jan_Sales

PRESS: Enter - On your own name the other cells, D7, D8, and D9;

"Gro_Rate", "Sell_Exp," and "Gen_Exp" respectively.

- Now, enter the formula to calculate February sales:

SELECT: Cell C13

TYPE: =b13*(1+Gro_rate)

CLICK: Fill handle, and

DRAG: to column F. - To enter the formula for selling expense:

SELECT: cell c15

TYPE: =IF((b15=0),0,(c13*Sell_Exp))

Note: the parenthesis don’t affect the order of

operations, they are only there to make it easier to read the

formula.

CLICK and DRAG: to fill the formula across - To calculate general expenses:

SELECT: Cell C16

TYPE: =if(b13=0,0,

CLICK: Cell D9

TYPE: )

PRESS: Enter

Notice that Excel entered the range name, and not the cell

column and row reference. - To finish the worksheet:

SELECT: Cells B17:B18

Use the fill handle to copy the selected formulas in column

B across to column F. - Save your work. Print the worksheet. Close the file and

exit Excel.

Data File:  EX06HE02 (14.0K) EX06HE02 (14.0K) |

2002 McGraw-Hill Higher Education

2002 McGraw-Hill Higher Education