|

| 1 |  |

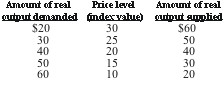

Answer the next question on the basis of the following aggregate demand and supply schedules for a hypothetical economy:

<a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0073273082/384258/quiz10b_1.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (6.0K)</a> <a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0073273082/384258/quiz10b_1.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (6.0K)</a>

Refer to the above data. If the full employment level of output is $500: |

|  | A) | this economy has a negative GDP gap |

|  | B) | this economy has a positive GDP gap |

|  | C) | the government could achieve the full employment level of output by increasing taxes |

|  | D) | this economy would move toward full employment if its currency appreciated |

|

|

|

| 2 |  |

A leftward shift of the aggregate supply curve would illustrate: |

|  | A) | demand-pull inflation |

|  | B) | an inflationary gap |

|  | C) | a positive GDP gap |

|  | D) | cost-push inflation |

|

|

|

| 3 |  |

At very low levels of output, the aggregate supply curve is relatively: |

|  | A) | flat, because firms are reluctant to give workers raises when output is so low |

|  | B) | flat, because firms can expand output with relatively little increase in per-unit production costs |

|  | C) | steep, because increasing output will cause relative large increases in per-unit production costs |

|  | D) | steep, because increasing output will cause aggregate demand to increase |

|

|

|

| 4 |  |

If real output per unit of input rises by 10%: |

|  | A) | measured productivity will increase |

|  | B) | per-unit production costs will rise |

|  | C) | the aggregate supply curve will shift to the left |

|  | D) | the price level will tend to increase |

|

|

|

| 5 |  |

The aggregate demand curve slopes downward to the right: |

|  | A) | because a lower domestic price level reduces net exports |

|  | B) | because of the income and substitution effects of lower prices |

|  | C) | at low prices, but not at high prices |

|  | D) | because a lower price level reduces the demand for money, which lowers the interest rate and increases desired investment |

|

|

|

| 6 |  |

Suppose that real domestic output in an economy is 200 units, the quantity of inputs is 50, and the price of each input is $20. The level of productivity is: |

|  | A) | 1/5 |

|  | B) | 2.5 |

|  | C) | 4 |

|  | D) | 10 |

|

|

|

| 7 |  |

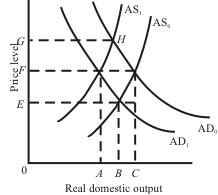

Use the following graph to answer the next question:

<a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0073273082/384258/quiz10b_7.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (10.0K)</a> <a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0073273082/384258/quiz10b_7.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (10.0K)</a>

Refer to the graph. Cost-push inflation is best illustrated by the shift from: |

|  | A) | AD0 to AD1 |

|  | B) | AD1 to AD0 |

|  | C) | AS0 to AS1 |

|  | D) | AS1 to AS0 |

|

|

|

| 8 |  |

All else equal, depreciation of the dollar will shift: |

|  | A) | both aggregate demand and aggregate supply to the left |

|  | B) | both aggregate demand and aggregate supply to the right |

|  | C) | aggregate demand to the left and aggregate supply to the right |

|  | D) | aggregate demand to the right and aggregate supply to the left |

|

|

|

| 9 |  |

If real output increases and the price level remains stable, it is likely that: |

|  | A) | both aggregate demand and aggregate supply have decreased |

|  | B) | aggregate demand has increased and aggregate supply has decreased |

|  | C) | aggregate demand has decreased and aggregate supply has increased |

|  | D) | both aggregate demand and aggregate supply have increased |

|

|

|

| 10 |  |

An increase in the incomes of U.S. trading partners would shift the U.S.: |

|  | A) | aggregate demand curve to the right |

|  | B) | aggregate demand curve to the left |

|  | C) | aggregate supply curve to the right |

|  | D) | aggregate supply curve to the left |

|

|