|

| 1 |  |

Assume the level of investment is independent of the level of GDP. If the interest rate rises, the investment schedule will: |

|  | A) | shift to the right |

|  | B) | shift to the left |

|  | C) | shift downward |

|  | D) | shift upward |

|

|

|

| 2 |  |

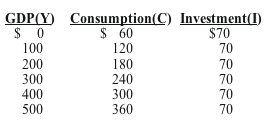

Answer the next question on the basis of the following data for a private closed economy. The letters Y, C, and I are used to represent GDP, consumption, and investment respectively.

<a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0073273082/384256/quiz9c_2.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (7.0K)</a> <a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0073273082/384256/quiz9c_2.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (7.0K)</a>

Refer to the table. At the $400 level of GDP, there will be: |

|  | A) | no unplanned change in inventories |

|  | B) | an unplanned increase in inventories of $30 |

|  | C) | an unplanned decrease in inventories of $30 |

|  | D) | an unplanned increase in inventories of $70 |

|

|

|

| 3 |  |

When planned injections of investment, government spending, and exports equal leakages of saving, taxes, and imports: |

|  | A) | aggregate expenditures will equal GDP |

|  | B) | consumption plus injections will be greater than aggregate expenditures |

|  | C) | net exports will be zero |

|  | D) | output will be below its equilibrium level |

|

|

|

| 4 |  |

An increase in planned investment spending will: |

|  | A) | decrease the interest rate |

|  | B) | increase GDP, causing an upward shift of the consumption schedule |

|  | C) | decrease the size of the trade deficit |

|  | D) | increase equilibrium GDP |

|

|

|

| 5 |  |

All else equal, if domestic consumers spend a greater fraction of their consumption expenditures on foreign-produced goods: |

|  | A) | aggregate expenditures and GDP will both increase |

|  | B) | aggregate expenditures and GDP will both decrease |

|  | C) | exports will also rise, offsetting the increase in imports |

|  | D) | the multiplier will increase |

|

|

|

| 6 |  |

Suppose the economy is suffering a recessionary expenditure gap. A depreciation of the nation's currency will: |

|  | A) | increase net exports and reduce the size of the recessionary expenditure gap |

|  | B) | decrease net exports, further increasing unemployment |

|  | C) | increase net exports, further increasing unemployment |

|  | D) | cause cost-push inflation |

|

|

|

| 7 |  |

A given decrease in lump-sum taxes will have a larger impact on real GDP the: |

|  | A) | smaller the MPC |

|  | B) | smaller the MPS |

|  | C) | smaller the size of the recessionary expenditure gap |

|  | D) | greater the APC |

|

|

|

| 8 |  |

GDP will rise if: |

|  | A) | investment plus saving plus exports exceeds consumption |

|  | B) | saving plus imports plus consumption exceeds GDP |

|  | C) | investment plus net exports exceeds the government's deficit |

|  | D) | investment plus government spending plus exports exceeds saving plus taxes plus imports |

|

|

|

| 9 |  |

If the MPC is .75, government could eliminate a $60 recessionary expenditure gap by: |

|  | A) | increasing government spending by $240 |

|  | B) | reducing lump-sum taxes by $80 |

|  | C) | reducing lump-sum taxes by $60 |

|  | D) | balancing its budget |

|

|

|

| 10 |  |

If the economy has a $20 billion recessionary expenditure gap and the MPC is 2/3, the equilibrium level of GDP is: |

|  | A) | $13 billion below its full-employment potential |

|  | B) | $20 billion below its full-employment potential |

|  | C) | $40 billion below its full-employment potential |

|  | D) | $60 billion below its full-employment potential |

|

|