|

| 1 |  |

In a private closed economy: |

|  | A) | saving always equals planned investment |

|  | B) | saving always equals actual investment |

|  | C) | unintended changes in inventories are always zero |

|  | D) | saving always equals the actual change in inventories |

|

|

|

| 2 |  |

At equilibrium real GDP in a private closed economy: |

|  | A) | saving equals the actual change in inventories |

|  | B) | the slope of the aggregate expenditures line is 1 |

|  | C) | real GDP equals aggregate expenditures |

|  | D) | planned saving equals unplanned investment |

|

|

|

| 3 |  |

The change in GDP associated with a change in government spending is: |

|  | A) | equal to the change in government spending |

|  | B) | smaller than -- and opposite in sign to -- that associated with an equal change in taxes |

|  | C) | smaller than -- and of same sign as -- that associated with an equal change in net exports |

|  | D) | larger than -- and opposite in sign to -- that associated with an equal change in taxes |

|

|

|

| 4 |  |

If the MPC is .8, a $100 billion increase in government spending will: |

|  | A) | increase GDP by $500, the same as would a $100 billion decrease in taxes |

|  | B) | increase GDP by $500, more than would a $100 billion decrease in taxes |

|  | C) | increase GDP by $500 if accompanied by a $100 billion increase in taxes |

|  | D) | have no impact on GDP if accompanied by a $100 billion increase in taxes |

|

|

|

| 5 |  |

A lump-sum tax increase will: |

|  | A) | shift the aggregate expenditures line upward by the amount of the tax increase |

|  | B) | shift the aggregate expenditures line downward by the amount of the tax increase |

|  | C) | shift the aggregate expenditures line downward by an amount less than the tax increase |

|  | D) | not affect the aggregate expenditures line |

|

|

|

| 6 |  |

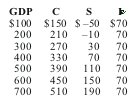

Answer the next question on the basis of the following information for a private open economy. The letters Y, C, Ig, X, and M stand for GDP, consumption, gross investment, exports, and imports respectively. All figures are in billions of dollars.

<a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0073273082/384256/quiz9a_6.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (2.0K)</a> <a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0073273082/384256/quiz9a_6.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (2.0K)</a>

The equilibrium level of GDP for this economy is: |

|  | A) | $450 |

|  | B) | $420 |

|  | C) | $400 |

|  | D) | $224 |

|

|

|

| 7 |  |

If the MPC is .75 and the economy has a recessionary expenditure gap of $10 billion, then equilibrium GDP is: |

|  | A) | $10 billion below the full-employment GDP |

|  | B) | $10 billion above the full-employment GDP |

|  | C) | $40 billion below the full-employment GDP |

|  | D) | $40 billion above the full-employment GDP |

|

|

|

| 8 |  |

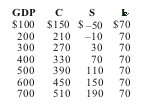

Use the following table for the next question. All figures are in billions of dollars.

<a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0073273082/384256/quiz9a_8.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (5.0K)</a> <a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0073273082/384256/quiz9a_8.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (5.0K)</a>

Refer to the table. Assuming no government or foreign sector, the equilibrium level of GDP in this closed economy is: |

|  | A) | $200 billion |

|  | B) | $300 billion |

|  | C) | $400 billion |

|  | D) | $500 billion |

|

|

|

| 9 |  |

Use the following table for the next question. Initially, government spending and taxes are zero, as are net exports. All figures are in billions of dollars.

<a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0073273082/384256/quiz9a_9.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (5.0K)</a> <a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0073273082/384256/quiz9a_9.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (5.0K)</a>

Refer to the table. If government spending rises to $80 billion and taxes remain at zero, equilibrium GDP will be: |

|  | A) | $300 billion |

|  | B) | $400 billion |

|  | C) | $500 billion |

|  | D) | $600 billion |

|

|

|

| 10 |  |

Assume the MPC is 2/3. If government spending decreases by $6 billion, equilibrium GDP will: |

|  | A) | fall by $2 billion |

|  | B) | fall by $18 billion |

|  | C) | fall by $6 billion |

|  | D) | fall by $4 billion |

|

|