FOCUS COMPANY: Maxidrive Corporation VALUING AN ACQUISITION USING FINANCIAL STATEMENT INFORMATION* |

In January, Exeter Investors purchased Maxidrive Corp., a fast-growing manufacturer of personal computer disk drives, for $33 million. The price Exeter paid was determined by considering the value of Maxidrive's assets, its debts to others, its ability to sell goods for more than the cost to produce them, and its ability to generate the cash necessary to pay its current bills. Much of this assessment was based on financial information that Maxidrive provided to Exeter in the form of financial statements. By July, Exeter had discovered a variety of problems in the company's operations and its financial statements. Maxidrive appeared to be worth only about half of what Exeter had paid for the company. Furthermore, Maxidrive did not have enough cash to pay its debt to American Bank. Exeter Investors filed a lawsuit against the previous owners and others responsible for Maxidrive's financial statements to recover its losses. UNDERSTANDING THE BUSINESS The PlayersMaxidrive was founded by two engineers who had formerly worked for General Data, then a manufacturer of large computers. Predicting the rise in demand for personal computers with a hard disk drive, they started a company to manufacture this component. The founders invested a major portion of their savings, becoming the sole owners of Maxidrive. As is common in new businesses, the founders also functioned as managers of the business (they were owner-managers). The founders soon discovered that they needed additional money to develop the business. Based on the recommendation of a close friend, they asked American Bank for a loan. American Bank continued to lend to Maxidrive as the need arose, becoming its largest lender, or creditor. Early last year, one of the founders of the business became gravely ill. This event, plus the stresses of operating in their highly competitive industry, led the founders to search for a buyer for their company. In January of this year, they struck a deal for the sale of the company to Exeter Investors, a small group of wealthy private investors. Both founders retired and a new manager was hired to run Maxidrive for the new owners. The new manager worked on behalf of Exeter Investors, but was not an owner of the company. Whether investors are groups such as Exeter who recently bought all of Maxidrive Corp. or individuals who buy small percentages of large corporations, they make their purchases hoping to gain in two ways. They hope to receive a portion of what the company earns in the form of cash payments called dividends and eventually sell their share of the company at a higher price than they paid. As the Maxidrive case suggests, not all companies increase in value or have sufficient cash to pay dividends. Creditors lend money to a company for a specific length of time. They hope to gain by charging interest on the money they lend. As American Bank, Maxidrive's major creditor, has learned, some borrowers cannot repay their debts. When Maxidrive borrows additional money or pays back money to its lenders and receives additional funds or pays dividends to owners, these are called financing activities. When Maxidrive buys or sells items such as plant and equipment used in producing disk drives, these are called investing activities. The Business OperationsTo understand any company's financial statements, you must first understand its operating activities. As noted, Maxidrive designs and manufactures hard disk drives for personal computers. The major parts that go into the drive include the disks on which information is stored, the motors that spin the disks, the heads that read and write to the disks, and the computer chips that control the operations of the drive. Maxidrive purchases the disks and motors from other companies, called suppliers. It designs and manufactures the heads and chips and then assembles the drives. Maxidrive does not sell disk drives directly to the public. Instead, its customers are computer manufacturers such as Dell Inc. and Apple Inc. which install the drives in machines they sell to retailers such as Best Buy and to consumers. Thus, Maxidrive is a supplier to Dell and Apple. |  <a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0073324833/lib26886_cut0101a.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (K)</a> <a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0073324833/lib26886_cut0101a.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (K)</a>

|

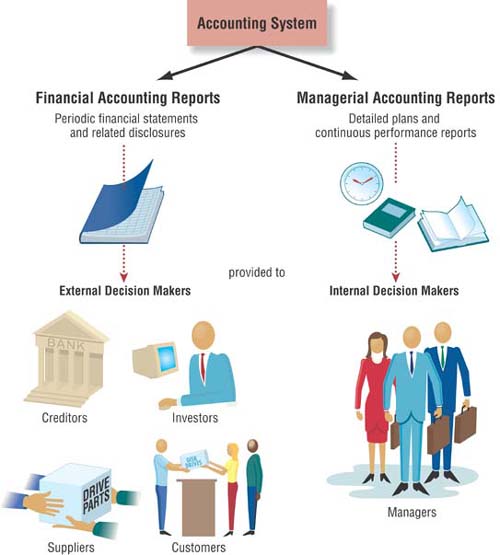

The Accounting SystemLike all businesses, Maxidrive has an accountingis a system that collects and processes (analyzes, measures, and records) financial information about an organization and reports that information to decision makers. system that collects and processes financial information about an organization and reports that information to decision makers. Maxidrive's managers (often called internal decision makers) and parties outside the firm such as Exeter Investors and American Bank (often called external decision makers) use the reports produced by this system. Exhibit 1.1 outlines the two parts of the accounting system. Internal managers typically require continuous, detailed information because they must plan and manage the day-to-day operations of the organization. Developing accounting information for internal decision makers, called managerial or management accounting, is the subject of a separate accounting course. The focus of this text is accounting for external decision makers, called financial accounting, and the four basic financial statements and related disclosures that are the output of that system. | EXHIBIT 1.1 | The Accounting System and Decision Makers |  <a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0073324833/lib26886_0101.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (K)</a> <a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0073324833/lib26886_0101.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (K)</a>

|

|

Learning Objective 1 Recognize the information conveyed in each of the four basic financial statements and the way that it is used by different decision makers (investors, creditors, and managers). |

We begin with a brief but comprehensive overview of the information reported in four basic financial statements and the people and organizations involved in their preparation and use. This overview provides you a context in which you can learn the more detailed material presented in the following chapters. In particular, we focus on how two primary users of the statements, investors (owners) and creditors (lenders), relied on each of Maxidrive's four basic financial statements in their ill-fated decisions to buy and lend money to Maxidrive. Then we discuss the ethical and legal responsibilities of various parties for those errors. To understand the way in which Exeter Investors used Maxidrive's financial statements in its decision and the way it was misled, we must first understand what specific information is presented in the four basic financial statements for a company such as Maxidrive. Rather than trying to memorize the definitions of every term used in this chapter, try to focus your attention on learning the general structure and content of the statements. Specifically: |  <a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0073324833/ipod_icon.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (K)</a> <a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0073324833/ipod_icon.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (K)</a>

Video 1-1

|

What categories of items (often called elements) are reported on each of the four statements? (What type of information does a statement convey, and where can you find it?) How are the elements within a statement related? (These relationships are usually described by an equation that tells you how the elements fit together.) Why is each element important to owners' or creditors' decisions? (How important is the information to decision makers?)

The self-study quizzes will help you assess whether you have reached these goals. Remember that since this chapter is an overview, each concept discussed here will be discussed again in Chapters 2 through 5. |