Although financial statement fraud is a fairly rare event, the misrepresentations in Maxidrive's statements aptly illustrate the importance of fairly presented financial statements to investors and creditors. They also indicate the crucial importance of the public accounting profession in ensuring the integrity of the financial reporting system. The recent Enron and WorldCom debacles have brought the importance of these issues to the attention of the general public. As noted at the beginning of this chapter, Maxidrive is not a real company but is based on a real company that perpetrated a similar fraud. (The focus companies and contrasting examples in the remaining chapters are real companies.) Maxidrive is loosely based on the infamous fraud at MiniScribe, a real disk drive manufacturer. The size of the real fraud, however, was more than 10 times as great as that in the fictional case, as were the losses incurred and the damages claimed in the lawsuits that followed. (Many of the numbers in Maxidrive's financial statements are simply one-tenth the amounts presented in MiniScribe's fraudulent statements.) The nature of the fraud also was quite similar. At MiniScribe, sales revenue was overstated by transferring nonexistent inventory between two facilities and creating phony documents to make it look as though the inventory was transferred to customers. MiniScribe even packaged bricks as finished products, shipped them to distributors, and counted them as sold. Cost of goods sold was understated by activities such as counting scrap parts and damaged drives as usable inventory. MiniScribe managers even broke into the auditors' locked trunks to change numbers on their audit papers. As a consequence, MiniScribe reported net income of $31 million, which was subsequently shown to be $9 million. MiniScribe's investors and creditors filed lawsuits claiming more than $1 billion in damages. Actual damages in the hundreds of millions were paid. Both the chairman and the chief financial officer of MiniScribe were convicted of federal securities and wire fraud charges and sentenced to jail. Although most managers and owners act in an honest and responsible fashion, this incident, and the much larger frauds at Enron and WorldCom, are stark reminders of the economic consequences of lack of fair presentation in financial reports. Both companies were forced into bankruptcy when their fraudulent financial reporting practices were brought to light. Penalties against their audit firm, Arthur Andersen, also led to its bankruptcy and dissolution. A sampling of firms that have recently been involved in financial statement misrepresentations follows:

Enron WorldCom Adelphia Global Crossing Computer Associates Tyco HealthSouth McKesson Xerox Rite-Aid Aurora Foods Halliburton | Parmalat Nortel Goodyear Cardinal Health Homestore.com Dynegy Fannie Mae Freddie Mac Qwest Communications Gerber Scientific Stanley Works AIG |

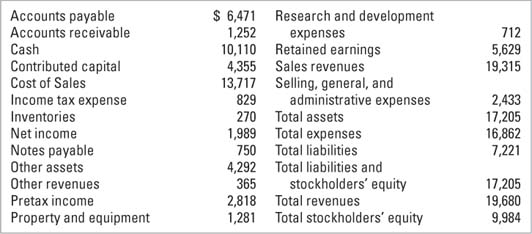

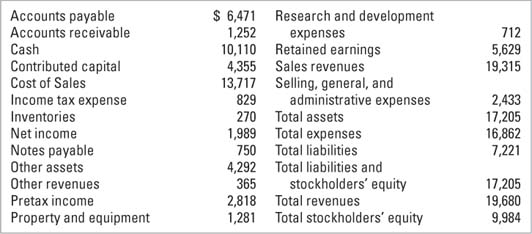

Apple Inc. | At the end of most chapters, one or more demonstration cases are presented. These cases provide an overview of the primary issues discussed in the chapter. Each demonstration case is followed by a recommended solution. You should read the case carefully and then prepare your own solution before you study the recommended solution. This self-evaluation is highly recommended. The introductory case presented here reviews the elements reported on the income statement and balance sheet and how the elements within the statements are related. Apple's iPods, iPhones, and iTunes stores have become the center of the digital lifestyle for professionals and consumers alike. Extensive iPod content is even available for this textbook. The ease-of-use, seamless integration, and innovative design of Apple's products have produced record profits and stock price for Apple's shareholders. Following is a list of the financial statement items and amounts adapted from a recent Apple income statement and balance sheet. The numbers are presented in millions of dollars for the year ended September 30, 2006.

<a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0073324833/pg24_1.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (K)</a> <a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0073324833/pg24_1.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (K)</a>

Required: Prepare a balance sheet and an income statement for the year following the formats in Exhibit 1.2 and Exhibit 1.3. Specify what information these two statements provide. Indicate the other two statements that would be included in its annual report. Securities regulations require that Apple's statements be subject to an independent audit. Suggest why Apple might voluntarily subject its statements to an independent audit if there were no such requirement.

SUGGESTED SOLUTION-

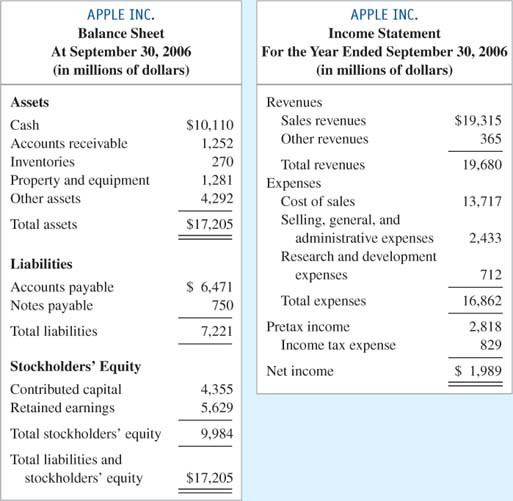

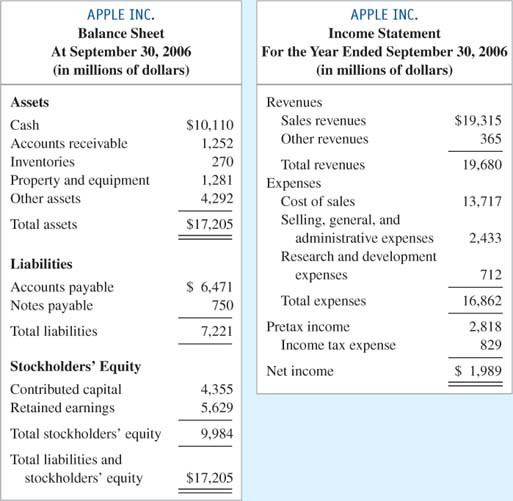

<a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0073324833/pg25_1.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (K)</a> <a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0073324833/pg25_1.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (K)</a>

The balance sheet reports the amount of assets, liabilities, and stockholders' equity of an accounting entity at a point in time. The income statement reports the accountant's primary measure of performance of a business, revenues less expenses, during the accounting period. Apple would also present a statement of retained earnings and a statement of cash flows. Users will have greater confidence in the accuracy of financial statement information if they know that the people who audited the statements were required to meet professional standards of ethics and competence.

|

|

|