|

| 1 |  |

Use the following diagram to answer the next question.

<a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0073365955/627578/q1.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (15.0K)</a> <a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0073365955/627578/q1.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (15.0K)</a>

Refer to the diagram. Suppose the economy's income distribution is represented by line b. An increase in income inequality would be represented by a movement: |

|  | A) | to line a |

|  | B) | up and to the right along line b |

|  | C) | to line c |

|  | D) | down and to the left along line b |

|

|

|

| 2 |  |

In 2006, approximately how much income was required for a household to reach the highest quintile? |

|  | A) | $48,000 |

|  | B) | $97,000 |

|  | C) | $176,000 |

|  | D) | $475,000 |

|

|

|

| 3 |  |

Since 1970, the U.S. distribution of income has: |

|  | A) | remained essentially the same, although the distribution of wealth has become substantially more unequal |

|  | B) | exhibited a substantial decrease in income mobility |

|  | C) | become less unequal owing to the falling returns from education |

|  | D) | become more unequal, partly owing to increased demand for highly skilled workers |

|

|

|

| 4 |  |

Because economic discrimination arbitrarily blocks women and minorities from higher productivity jobs, discrimination: |

|  | A) | creates inflation |

|  | B) | reduces overall productivity |

|  | C) | redistributes income but does not reduce it overall |

|  | D) | moves an economy downward along its production possibilities frontier |

|

|

|

| 5 |  |

In 2006, the share of income accruing to households in the bottom quintile was: |

|  | A) | less than 1% |

|  | B) | between 3% and 4% |

|  | C) | larger than it was in 1970 |

|  | D) | the same as the share of income accruing to households in the middle quintile |

|

|

|

| 6 |  |

One can make a logical case for redistributing income from rich to poor by arguing that: |

|  | A) | the total utility of income for the rich exceeds that of the poor |

|  | B) | the marginal utility of income for the poor exceeds that of the rich |

|  | C) | income redistribution increases the incentives to work |

|  | D) | income redistribution helps to fill up poor persons' leaky buckets |

|

|

|

| 7 |  |

Compared to annual incomes, lifetime incomes exhibit: |

|  | A) | less inequality, reflecting substantial income mobility |

|  | B) | more inequality, reflecting substantial income mobility |

|  | C) | more inequality, reflecting very little income mobility |

|  | D) | about the same inequality, reflecting very little income mobility |

|

|

|

| 8 |  |

Regarding the effect of taxes and transfer payments on the U.S. income distribution, data indicate that: |

|  | A) | there is virtually no impact |

|  | B) | the progressive tax system accounts for over half of the reduction in income inequality |

|  | C) | tax rebates and credits account for over half of the income of those in the lowest quintile |

|  | D) | roughly 80% of the reduction in income inequality is attributable to transfer payments |

|

|

|

| 9 |  |

Which of the following is the basic welfare program for low-income families in the U.S.? |

|  | A) | OASDHI |

|  | B) | SSI |

|  | C) | TANF |

|  | D) | EITC |

|

|

|

| 10 |  |

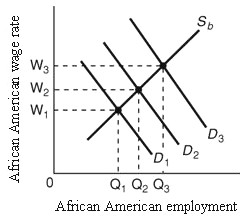

Use the following diagram to answer the next question:

<a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0073365955/627578/q10.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (21.0K)</a> <a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0073365955/627578/q10.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (21.0K)</a>

Refer to the diagram: Suppose demand is initially given by D2. Which of the following would shift demand to D3? |

|  | A) | A decrease in the productivity of African American workers |

|  | B) | A reduction in white employers' discrimination coefficients |

|  | C) | An increase in white employers' discrimination coefficients |

|  | D) | A reduction in employment discrimination coupled with an increase in statistical discrimination |

|

|