|

| 1 |  |

A typical household uses the largest share of its total income for: |

|  | A) | personal consumption expenditures |

|  | B) | combined income, payroll, sales, and property taxes |

|  | C) | personal saving |

|  | D) | food |

|

|

|

| 2 |  |

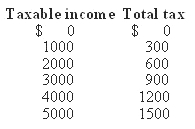

Refer to the following:

<a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0073365955/627561/q2.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (10.0K)</a> <a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0073365955/627561/q2.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (10.0K)</a>

The tax represented in the table above is: |

|  | A) | regressive |

|  | B) | proportional |

|  | C) | progressive |

|  | D) | optimal |

|

|

|

| 3 |  |

Considering average state-level spending and revenue: |

|  | A) | most spending is for police and fire protection |

|  | B) | most spending is for health care and hospital administration |

|  | C) | the largest source of revenue is taxes on income |

|  | D) | the largest sources of revenue are sales and excise taxes |

|

|

|

| 4 |  |

Refer to the following, in which solid arrows are real flows and broken arrows are monetary flows.

<a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0073365955/627561/q4.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (26.0K)</a> <a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0073365955/627561/q4.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (26.0K)</a>

Flow 3 might represent: |

|  | A) | federal government bond purchases |

|  | B) | wages paid to chemists at the Environmental Protection Agency |

|  | C) | tax refunds from filing federal income taxes |

|  | D) | federal disability payments |

|

|

|

| 5 |  |

In a corporation, one primary principal–agent relationship is exemplified by: |

|  | A) | owner–stockholder |

|  | B) | stockholder–manager |

|  | C) | hourly worker–salaried employee |

|  | D) | bond holder–stockholder |

|

|

|

| 6 |  |

Good X is characterized by nonrivalry and nonexcludability; good Y is characterized by neither. If both are economically desirable, then: |

|  | A) | both can be efficiently provided by private firms |

|  | B) | X can be efficiently provided by private firms but Y must be financed through taxes |

|  | C) | Y can be efficiently provided by private firms but X must be financed through taxes |

|  | D) | both must be financed through taxes |

|

|

|

| 7 |  |

Positive externalities are most likely to be found in the production of: |

|  | A) | illegal drugs |

|  | B) | DVD recording devices |

|  | C) | milk and dairy products |

|  | D) | secondary education |

|

|

|

| 8 |  |

Regarding the functional distribution of income in the U.S., which of the following constitutes about 70% of total income? |

|  | A) | The top 20% of households |

|  | B) | Consumption spending |

|  | C) | Business profits |

|  | D) | Wages and salaries |

|

|

|

| 9 |  |

If your income increases from $40,000 per year to $41,000 per year and your tax increases from $1000 to $1050, the marginal tax rate is: |

|  | A) | $50 |

|  | B) | 2.5% |

|  | C) | 5% |

|  | D) | 10% |

|

|

|

| 10 |  |

Bees from a keeper's hive can pollinate fruit trees for many surrounding orchards. Therefore, the production of honey: |

|  | A) | generates a positive externality and should be encouraged through subsidies |

|  | B) | generates a positive externality, however resources are correctly allocated in this market |

|  | C) | generates a negative externality and should be discouraged through taxes |

|  | D) | needs no government interaction. Beekeepers reap all private benefits |

|

|