|

| 1 |  |

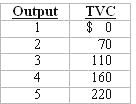

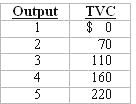

The WXY Corporation has fixed costs of $50. Its total variable costs (TVC) vary with output as shown in the following table.

<a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0073365955/627565/q1.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (6.0K)</a> <a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0073365955/627565/q1.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (6.0K)</a>

Refer to the table. The average total cost of 4 units of output is: |

|  | A) | $27.50 |

|  | B) | $40.00 |

|  | C) | $52.50 |

|  | D) | $210.00 |

|

|

|

| 2 |  |

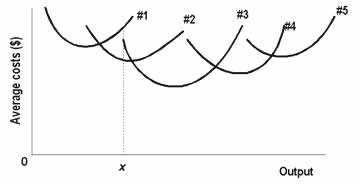

Use the following graph to answer the next question:

<a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0073365955/627565/q2.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (6.0K)</a> <a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0073365955/627565/q2.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (6.0K)</a>

The diagram shows the short-run average total cost curves for five different plant sizes for a firm. The firm experiences economies of scale over the range of plant sizes: |

|  | A) | 1 through 2 only |

|  | B) | 1 through 3 only |

|  | C) | 1 through 5 |

|  | D) | 3 through 5 only |

|

|

|

| 3 |  |

Explicit costs and implicit costs: |

|  | A) | are alike in that both represent opportunity costs |

|  | B) | are alike in that both reflect an outlay of cash |

|  | C) | are alike in that both are deducted from revenue to find accounting profit |

|  | D) | differ in that only explicit costs are deducted from revenue to find economic profit |

|

|

|

| 4 |  |

Suppose that a business incurred implicit costs of $300,000 and explicit costs of $1,300,000 over the past year. If the firm earned $1,400,000 in revenue, its: |

|  | A) | accounting profits were $400,000 and its economic profits were $100,000 |

|  | B) | accounting losses were $200,000 and its economic profits were $100,000 |

|  | C) | accounting profits were $100,000 and its economic profits were zero |

|  | D) | accounting profits were $100,000 and its economic losses were $200,000 |

|

|

|

| 5 |  |

Which one of the following short-run cost curves would not be affected by an increase in the wage paid to a firm's labor? |

|  | A) | Average variable cost |

|  | B) | Average fixed cost |

|  | C) | Average total cost |

|  | D) | Marginal cost |

|

|

|

| 6 |  |

If marginal product is positive but falling: |

|  | A) | marginal cost must also be falling |

|  | B) | average product must be falling |

|  | C) | total product is increasing at a decreasing rate |

|  | D) | total product is falling |

|

|

|

| 7 |  |

The distinguishing feature of the short run is that: |

|  | A) | at least one input is fixed |

|  | B) | output is fixed |

|  | C) | input prices are variable |

|  | D) | technology is variable |

|

|

|

| 8 |  |

The WXY Corporation has fixed costs of $30. Its total variable costs (TVC) vary with output as shown in the following table.

<a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0073365955/627565/q1.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (6.0K)</a> <a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0073365955/627565/q1.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (6.0K)</a>

Refer to the table. The marginal cost of the fourth unit of output is: |

|  | A) | $30 |

|  | B) | $40 |

|  | C) | $50 |

|  | D) | $60 |

|

|

|

| 9 |  |

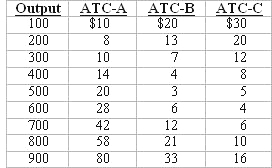

Use the following average total cost data to answer the next question. The letters A, B, and C designate three successively larger plant sizes.

<a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0073365955/627565/q9.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (22.0K)</a> <a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0073365955/627565/q9.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (22.0K)</a>

Refer to the data. In the long run, the firm should use plant size "A" for: |

|  | A) | all possible levels of output |

|  | B) | 100 to 200 units of output |

|  | C) | 300 to 600 units of output |

|  | D) | 600 or more units of output |

|

|

|

| 10 |  |

Suppose a particular firm exhibits constant returns to scale as it increases its output over any reasonable range. If it increases all its inputs by 10%, its: |

|  | A) | total cost will increase by less than 10% |

|  | B) | average total cost will increase by 10% |

|  | C) | output will increase by 10% |

|  | D) | long run average cost curve will shift to the right by 10% |

|

|