The stock market is in a slump. Savings are sagging. The economy is on the skids. One thing is still up: college tuition.

Parents saving for college face enormous challenges, which have been compounded by a complicated new tax law aimed at helping them.

"The new law delivers phantom benefits. It's so complicated that many people won't be able to take advantage of them," says David Lifson, an accountant at Hayes & Co. in Manhattan.

And for families whose children are already close to college age, the test is to manage college funds through the stock market downturn.

Michael Waggoner and Cindy Goff started saving for college when their children, Julie, 15, and Thomas, 12, were infants. That was before state-sponsored 529 college savings plans were widely available. So the Boulder, Colo., couple missed out on the plans' tax benefits, which will get even better starting next year.

Instead, Waggoner and Goff regularly have put money into the Vanguard Total Stock Market Index fund in a taxable account held in their names. Since its peak in early 2000, the value of their account has dropped about one-third, says Waggoner, associate dean for academic affairs at the University of Colorado Law School.

With three years until Julie starts college, the couple have started to put new contributions into more conservative investments. Waggoner believes the stock market will be higher in three years, so he's not selling mutual fund assets yet.

But in case the bear market lingers, he's considering options: student loans, scholarships, belt tightening and a second mortgage on their home.

Allan Watnick, a vice-president at a printing company in Pittsford, N.Y., already has taken out a home equity line of credit to pay for college. His oldest son enrolled at Wheaton College in August. A second son will start in 2003. Unfortunately, Watnik's college fund has lost more than half of its value since August 2000. About 50% of the portfolio is invested in Intel stock. The rest is invested in a variety of stocks, including Pepsi-Co and Harley-Davidson.

Watnik would rather mortgage his home than sell stocks at a loss. "I was blinded by a great market," he says. "All the books you read say that if your child is a year away from college, you should cash out some of your portfolio and put it aside. I violated that rule."

Age-Based Allocation

Many financial experts suggest a gradual shift to conservative investments as a child gets older. A split of 60% stock and stock mutual funds and 40% bonds and bond funds is appropriate for a college fund until a child reaches age 13, financial author Jonathan Pond says. Then each subsequent year, the equity portion should drop 10%, so that by age 17, you have 10% of the portfolio in risky investments. Pond acknowledges that plan may be too conservative for some investors.

In recent years, many parents like Watnick chose to ignore conventional wisdom about adjusting their asset allocation to their time horizon.

"They didn't want to hear it," says Faye Doria, a financial planner in Wolfeboro, N.H. That's why the age-based mutual funds offered by state-sponsored 529 college savings plans are a good choice for many investors. These funds do the allocating for you, automatically shifting to more conservative asset allocations as the child gets older.

Before you put your money in an aged-based funds, look at the sample portfolios that will be used at different ages. "Then you can be sure it matches your own risk tolerance and investment philosophy," Doria says.

Many 529 plans now offer a wider range of investment options, so parents can be adequately diversified. But if a plan doesn't offer the investment that you want, you may be able to open a tax-exempt Education Savings Account. Like a Roth IRA, these accounts give you broad control over investment choices. And starting next year, proceeds also can be used to pay for private elementary or secondary schools.

The limited investment choices and inability to shift assets in an existing 529 plan have been a drawback. If you had put all your money in an aggressive fund, you were locked into that choice unless you changed the beneficiary. But starting next year, parents will be able to adjust their asset allocation once a year. And parents can roll over assets from one 529 pan to another once a year. That's helpful as more attractive plans with lower management fees become available.

Portfolio Housecleaning

Many investors are naturally reluctant to sell investments at a loss even if it means coming up with money for college from another source. "Hope springs eternal," Ponds says.

But that hope may not be well founded. So, when the time comes to start shifting your college funds from stocks to bonds, take a close look at your investments. If a stock has posted big losses, try to assess its long-term outlook. If a mutual fund is down, check how it has performed compared with similar funds. If you think there's a good chance the investment will come back in the next few years, it may make sense to hang onto it and sell other investments first.

But if you really aren't sure, don't be afraid to sell. "It's not an either/or decision," Pond says. "Why not sell half of your shares, and if it comes back, you've got a stake in the ground."

Parents who started to save for college ten or fifteen years ago had fewer options. Many simply opened a custodial account and regularly put money into it. Earnings are taxable. Assets automatically go to the beneficiary when he or she reaches adulthood. At that point, your child can use the money for college or to buy a sports car.

Many parents would like to switch to a state sponsored 529 account, which are becoming more flexible and attractive all the time. Starting next year, earnings will be tax free when used for college expenses. There are several things to consider. Custodial accounts are rigid. They're irrevocable, and the beneficiary cannot be changed. By contrast, 529 plans let parents control the account and change beneficiaries.

Some states will allow you to transfer a custodial account to a 529 plan, with restrictions. You lose the ability to let another sibling or cousin use the money if the original beneficiary doesn't use it.

And 529 plans only accept cash, so you would have to liquidate the assets in the custodial account and pay any taxes on the capital gains. Consult your accountant about the tax implications.

There may be a better option, says Robert Doyle, an accountant at Spoor Doyle & Associates in St. Petersburg, Fla.: Simply stop making contributions to the custodial account and direct new money into a 529 plan.

The Shortfall

When it's finally time for your child to enter college, you may discover your college fund won't cover all the costs. For many families, the choice will come down to taking out a home equity loan or a student loan. Tapping home equity could set back your retirement. "I wouldn't be adverse to sticking Junior with some student loans," Pond says. "I wouldn't want to stick him with a $100,000 loan, but $30,000 wouldn't be onerous."

Starting next year, student loan interest is a better deduction than the interest on a home equity loan because it will become an above-the-line deduction. That means it reduces your adjusted gross income dollar for dollar.

Borrowing against your 401K retirement plan to pay for college should be taboo, experts say. "Your kids can get a job, apply for grants, scholarships or loans," Doyle says. "They'll find a way to go to college. But when you're ready to retire, you can't get a loan, grant or scholarship. You'll need that money."

Notice how Dugas quickly—in the fifth paragraph—provides the reader with a human-interest element. She introduces a family whose plans for their children's college tuition have had to change because of the stock market slump. She is buttressing her lead with an example. She goes on to another family, and then she writes about the recommendations of financial experts.

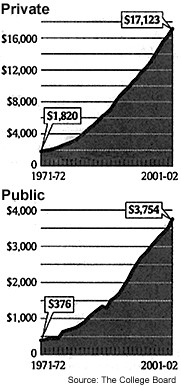

The column is accompanied by a survey of various college savings plans and a graph showing how tuition has increased in a 30-year period.

Note: These savings options could affect a child's financial aid eligibility.