|

| 1 |  |

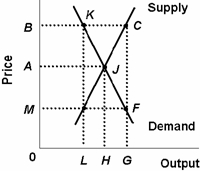

Use the following diagram to answer the next question; assume the demand and supply curves capture all relevant benefits and costs.

<a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0077337727/883732/ch05_q1.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (13.0K)</a> <a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0077337727/883732/ch05_q1.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (13.0K)</a>

Refer to the diagram. In this competitive market, total surplus (combined consumer and producer surplus) is maximized at: |

|  | A) | price M. |

|  | B) | price B. |

|  | C) | output G. |

|  | D) | output H. |

|

|

|

| 2 |  |

Suppose two goods, X and Y, are economically desirable in that there is some positive output at which total benefits exceed total costs. If good X is characterized by nonrivalry and nonexcludability but good Y is characterized by both rivalry and excludability, then: |

|  | A) | both can be efficiently provided by private firms. |

|  | B) | X can be efficiently provided by private firms but Y must be financed through taxes. |

|  | C) | Y can be efficiently provided by private firms but X must be financed through taxes. |

|  | D) | both goods must be financed through taxes. |

|

|

|

| 3 |  |

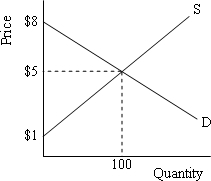

Answer the next question on the basis of the following diagram:

<a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0077337727/883732/ch05_q3.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (10.0K)</a> <a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0077337727/883732/ch05_q3.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (10.0K)</a>

Refer to the diagram. At the equilibrium price and quantity, consumer surplus in this market is: |

|  | A) | $3. |

|  | B) | $7. |

|  | C) | $150. |

|  | D) | $350. |

|

|

|

| 4 |  |

Positive externalities are most likely to be found in the production of: |

|  | A) | illegal drugs. |

|  | B) | DVD recording devices. |

|  | C) | milk and dairy products. |

|  | D) | secondary education. |

|

|

|

| 5 |  |

Bees from a keeper's hive can pollinate fruit trees for many surrounding orchards. Therefore, the production of honey: |

|  | A) | generates a positive externality and should be encouraged through subsidies. |

|  | B) | generates a positive externality, however resources are correctly allocated in this market. |

|  | C) | generates a negative externality and should be discouraged through taxes. |

|  | D) | needs no government intervention. Beekeepers reap all private benefits. |

|

|

|

| 6 |  |

Government has imposed a tax on the producers of good X and has subsidized the consumers of good Y. If these policies result in the production of the efficient amounts of both goods, it is likely the government is correcting for: |

|  | A) | external costs in producing X and external benefits in consuming Y. |

|  | B) | external benefits in producing X and external costs in consuming Y. |

|  | C) | external benefits in producing X and consuming Y. |

|  | D) | external costs in producing X and consuming Y. |

|

|

|

| 7 |  |

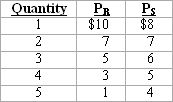

Answer the next question on the basis of the following information for a public good. PR and PS are the prices that Rafael and Sarah, respectively, are willing to pay for the marginal unit of a public good, rather than do without it. Rafael and Sarah are the only members of society.

<a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0077337727/883732/ch05_q7.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (9.0K)</a> <a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0077337727/883732/ch05_q7.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (9.0K)</a>

Refer to the table. Suppose the public good can be provided by the government at a constant marginal cost of $7. The optimal quantity of the public good is: |

|  | A) | 1 unit. |

|  | B) | 2 units. |

|  | C) | 3 units. |

|  | D) | 4 units. |

|

|

|

| 8 |  |

Compared to the efficient amount, suppose too many resources are allocated to the production of some good. The most likely explanation is that: |

|  | A) | production of this good creates external costs. |

|  | B) | production of this good creates external benefits. |

|  | C) | this good is characterized by nonrivalry and nonexcludability. |

|  | D) | this is a "public good". |

|

|

|

| 9 |  |

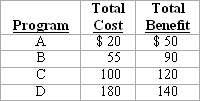

Answer the next question on the basis of the following information for four city beautification programs of increasing scope. All figures are in millions of dollars.

<a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0077337727/883732/ch05_q9.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (12.0K)</a> <a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0077337727/883732/ch05_q9.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (12.0K)</a>

Refer to the table. On economic grounds, the most efficient program is: |

|  | A) | A. |

|  | B) | B. |

|  | C) | C. |

|  | D) | D. |

|

|

|

| 10 |  |

After his car broke down on a hot day, Jack walked more than a mile to the nearest convenience store and paid $1 for a bottle of water. Considering his thirst, he would willingly have paid $3. Jack's consumer surplus is: |

|  | A) | $1. |

|  | B) | $2. |

|  | C) | $3. |

|  | D) | $4. |

|

|