|

| 1 |  |

Which of the following federal taxes is most progressive? |

|  | A) | Corporate income tax |

|  | B) | Personal income tax |

|  | C) | Social security tax |

|  | D) | Medicare tax |

|

|

|

| 2 |  |

All else equal, the more elastic the demand and supply of the good being taxed, the greater the efficiency loss of an excise tax. |

|  | A) | True |

|  | B) | False |

|

|

|

| 3 |  |

The alleged inefficiency of public bureaucracies arises primarily because: |

|  | A) | the voting paradox leads to too little public output |

|  | B) | special interests work to assure the passage of projects whose costs exceed their benefits |

|  | C) | public sector workers have less training than their private sector counterparts |

|  | D) | competitive pressures of the market are largely absent |

|

|

|

| 4 |  |

An excise tax imposed on sellers is more likely to be shifted onto consumers: |

|  | A) | the more inelastic the supply |

|  | B) | the more inelastic the demand |

|  | C) | the more elastic the demand |

|  | D) | the higher the price of the product |

|

|

|

| 5 |  |

Consider the following observations regarding the markets for products A, B, C, and D:

A: demand and supply are both relatively inelastic

B: demand and supply are both relatively elastic

C: demand is elastic and supply is inelastic

D: demand is inelastic and supply is elastic

In which market will the largest portion of an excise tax be borne by sellers? |

|  | A) | A |

|  | B) | B |

|  | C) | C |

|  | D) | D |

|

|

|

| 6 |  |

The city council composed of six people is considering three different park expansion proposals. Two council members prefer a bigger park to any smaller park; two others prefer a smaller park to anything bigger. The final two prefer a moderate-size park to either extreme. The final outcome of the vote will: |

|  | A) | depend on which pair of alternatives is voted on first |

|  | B) | be the largest park |

|  | C) | be the smallest park |

|  | D) | be the moderate size park |

|

|

|

| 7 |  |

A public choice economist would most likely study: |

|  | A) | the impact of discrimination in labor markets |

|  | B) | the effect of logrolling on congressional decisions |

|  | C) | the effect of changes in the money supply on interest rates |

|  | D) | the relationship between technological change and economic growth |

|

|

|

| 8 |  |

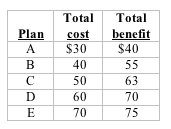

A cost-benefit analysis of five possible plans for renovating a city's opera house is as follows (all figures are in millions of dollars):

<a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/1113273090/384260/quiz29b_8.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (7.0K)</a> <a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/1113273090/384260/quiz29b_8.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (7.0K)</a>

Based on the cost-benefit analysis, the city should: |

|  | A) | not renovate the opera house |

|  | B) | proceed with plan B |

|  | C) | proceed with plan C |

|  | D) | proceed with plan D |

|

|

|

| 9 |  |

The two primary philosophies regarding the apportionment of the tax burden are: |

|  | A) | willingness to pay and benefits received |

|  | B) | inelastic supply and inelastic demand |

|  | C) | majority rule and the median voter |

|  | D) | benefits received and ability to pay |

|

|

|

| 10 |  |

The overall U.S. federal tax system is moderately regressive. |

|  | A) | True |

|  | B) | False |

|

|