|

| 1 |  |

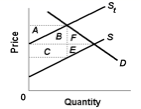

Use the following diagram to answer the next question.

<a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/1113273090/384260/quiz29c_1.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (6.0K)</a> <a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/1113273090/384260/quiz29c_1.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (6.0K)</a>

Refer to the diagram, in which pre-tax supply and demand are given by S and D, respectively, and St reflects the imposition of an excise tax. The proportion of the total tax paid by consumers is: |

|  | A) | (A + B) / (A + B + F) |

|  | B) | (A + B + C) / (A + B + C + E + F) |

|  | C) | F / (E + F) |

|  | D) | (A + B) / (A + B + C) |

|

|

|

| 2 |  |

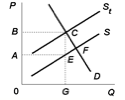

Use the following diagram to answer the next question.

<a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/1113273090/384260/quiz29c_2.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (5.0K)</a> <a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/1113273090/384260/quiz29c_2.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (5.0K)</a>

Refer to the diagram, in which pre-tax supply and demand are given by S and D, respectively, and St reflects the imposition of an excise tax. Which of the following is not a predicted outcome of the tax? |

|  | A) | The tax is fully shifted onto consumers |

|  | B) | Total tax collection is equal to area ABCE |

|  | C) | An efficiency loss equal to area ECF |

|  | D) | Equilibrium quantity falls to G |

|

|

|

| 3 |  |

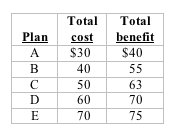

A cost-benefit analysis of five possible plans for renovating a city's opera house is as follows (all figures are in millions of dollars):

<a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/1113273090/384260/quiz29c_3.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (6.0K)</a> <a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/1113273090/384260/quiz29c_3.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (6.0K)</a>

Refer to the table. A five-member city council must decide by pairwise majority rule to proceed with only one of the five plans. Each of the plans has the full support of exactly one council member; the further the cost of the plan from each member's preferred option, the less she likes it. The outcome of this selection process will be: |

|  | A) | indeterminate, as predicted by the voting paradox |

|  | B) | plan B, as predicted by the median voter principle |

|  | C) | plan C, as predicted by the median voter principle |

|  | D) | plan D, as predicted by the median voter principle |

|

|

|

| 4 |  |

Which of the following is an example of rent-seeking behavior? |

|  | A) | The rich pay a greater proportion of their income in taxes than the poor |

|  | B) | Lobbyists for U.S. automakers secure a tariff on imported automobiles |

|  | C) | The Congresswoman from California agrees to vote yes on a proposal advocated by the Congressman from South Carolina in exchange for a yes vote from him on another proposal |

|  | D) | Political candidates tend to move toward a centrist position as the election nears |

|

|

|

| 5 |  |

If someone earning $50,000 pays $10,000 in taxes and someone earning $80,000 pays $20,000 in taxes, then over this range the tax is: |

|  | A) | proportional |

|  | B) | progressive |

|  | C) | regressive |

|  | D) | retrograde |

|

|

|

| 6 |  |

Most states tax gasoline and use the proceeds to build and maintain highways. This tax best reflects: |

|  | A) | the ability-to-pay principle |

|  | B) | the benefits-received principle |

|  | C) | the comparative advantage principle |

|  | D) | the diminishing returns principle |

|

|

|

| 7 |  |

Which of the following taxes is most likely to be regressive? |

|  | A) | Personal income tax |

|  | B) | Corporate income tax |

|  | C) | Payroll tax |

|  | D) | Excise tax on furs |

|

|

|

| 8 |  |

Suppose the supply of a particular good is perfectly elastic, and the demand is moderately inelastic. A $1.00 excise tax placed on the sellers of the product will do all of the following except: |

|  | A) | reduce the price sellers receive by $1.00 |

|  | B) | increase the price consumers pay by $1.00 |

|  | C) | reduce the quantity sold |

|  | D) | create an efficiency loss |

|

|

|

| 9 |  |

The demand for gasoline is more elastic in the long run than the short run. All else equal, this implies that over time, an excise tax on gasoline will: |

|  | A) | increasingly be passed on to consumers |

|  | B) | increasingly be paid by sellers |

|  | C) | have a shrinking efficiency loss |

|  | D) | generate increasing tax revenues |

|

|

|

| 10 |  |

By law, the payroll tax is levied equally on workers and their employees, each paying 7.65%. In the aggregate, the supply of labor is essentially perfectly inelastic. Combining these two observations, we can conclude that the true burden of the tax: |

|  | A) | is equally shared by employers and workers |

|  | B) | falls mostly on employers |

|  | C) | falls fully on employers |

|  | D) | falls fully on workers |

|

|