|

| 1 |  |

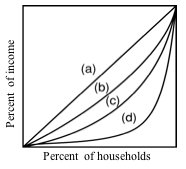

Use the following diagram to answer the next question.

<a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/1113273090/384260/quiz32b_1.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (8.0K)</a> <a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/1113273090/384260/quiz32b_1.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (8.0K)</a>

Refer to the diagram. The curves (a) through (d) shown in the diagram are known as: |

|  | A) | income curves |

|  | B) | Gini curves |

|  | C) | Lorenz curves |

|  | D) | level curves |

|

|

|

| 2 |  |

Suppose an economy consists of only five households, whose incomes are $10,000, $15,000, $25,000, $50,000, and $100,000 respectively. If these data were plotted as a Lorenz curve, what percent of income would correspond to the lowest 60% of households? |

|  | A) | .125% |

|  | B) | 12.5% |

|  | C) | 25% |

|  | D) | 40% |

|

|

|

| 3 |  |

Suppose a public assistance plan provides a minimum annual income of $10,000 and a 40% benefit-reduction rate. The break-even level of income for this plan is: |

|  | A) | $20,000 |

|  | B) | $25,000 |

|  | C) | $40,000 |

|  | D) | $50,000 |

|

|

|

| 4 |  |

In 2004, approximately how much income was required for a household to reach the highest quintile? |

|  | A) | $48,000 |

|  | B) | $88,000 |

|  | C) | $176,000 |

|  | D) | $475,000 |

|

|

|

| 5 |  |

The Personal Responsibility Act of 1996 was passed because policy-makers generally agreed that Aid to Families with Dependent Children—the previous welfare system: |

|  | A) | provided states insufficient funds to combat poverty |

|  | B) | was too heavily dependent on in-kind benefits rather than cash benefits |

|  | C) | punished children for their parents' inability to find employment |

|  | D) | reduced work incentives and created welfare dependency |

|

|

|

| 6 |  |

The quintile distribution of household income: |

|  | A) | refers to the amount of income received by groups of 500 households |

|  | B) | refers to the number of households receiving one-fifth of total income |

|  | C) | refers to the percentage of total income received by one-fifth of the households |

|  | D) | is more unequal than the quintile distribution of household wealth |

|

|

|

| 7 |  |

"Social Security" is the collective name given to all the social insurance programs available in the U.S., including Temporary Assistance to Needy Families, Unemployment Insurance, Food Stamps, and Medicaid. |

|  | A) | True |

|  | B) | False |

|

|

|

| 8 |  |

One can make a case for redistributing income on economic efficiency grounds by arguing that: |

|  | A) | the total utility of income for the rich exceeds that of the poor |

|  | B) | the marginal utility of income for the poor exceeds that of the rich |

|  | C) | income redistribution increases the incentives to work |

|  | D) | income redistribution helps to fill up poor persons' leaky buckets |

|

|

|

| 9 |  |

The distribution of wealth in the U.S.: |

|  | A) | contributes to inequality of income |

|  | B) | has a Gini ratio smaller than that of the distribution of income |

|  | C) | has become less unequal over the past 50 years |

|  | D) | is the same as the distribution of income |

|

|

|

| 10 |  |

All else equal, a public assistance plan's work incentives will be stronger, the: |

|  | A) | higher the minimum annual income |

|  | B) | lower the break-even income |

|  | C) | lower the benefit-reduction rate |

|  | D) | greater the number of "tax brackets" |

|

|