|

| 1 |  |

Price-taking behavior is a feature of: |

|  | A) | pure competition |

|  | B) | monopolistic competition |

|  | C) | oligopoly |

|  | D) | monopoly |

|

|

|

| 2 |  |

Oscar is one of many farmers growing soybeans in the upper Midwest under purely competitive market conditions. As Oscar perceives it, the demand curve for Oscar's soybeans: |

|  | A) | is downward sloping |

|  | B) | is perfectly inelastic |

|  | C) | coincides with Oscar's marginal revenue curve |

|  | D) | lies above his marginal revenue curve |

|

|

|

| 3 |  |

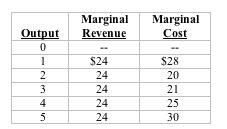

Use the following data to answer the next question.

<a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/1113273090/384258/quiz21c_3.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (8.0K)</a> <a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/1113273090/384258/quiz21c_3.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (8.0K)</a>

Refer to the table. Suppose the firm's goal is maximum profits (or minimum losses.) If this firm's minimum average variable cost is $23, the firm will produce: |

|  | A) | 0 units |

|  | B) | 2 units |

|  | C) | 3 units |

|  | D) | 4 units |

|

|

|

| 4 |  |

Answer the next question on the basis of the following cost data for a competitive firm.

<a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/1113273090/384258/quiz21c_3.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (8.0K)</a> <a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/1113273090/384258/quiz21c_3.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (8.0K)</a>

Refer to the above data. If the market price is $50 and the firm produces its optimal amount, it will: |

|  | A) | realize a $15 profit |

|  | B) | realize a $80 profit |

|  | C) | realize a $90 profit |

|  | D) | incur a $15 loss |

|

|

|

| 5 |  |

A competitive firm is currently producing 2000 units per month at a total cost of $12,000. Its fixed costs are $1,000 and its marginal cost is $5. If the market price is $5.60, this firm: |

|  | A) | should shut down |

|  | B) | should increase production |

|  | C) | is making an economic profit, but not an accounting profit |

|  | D) | is maximizing profits |

|

|

|

| 6 |  |

A purely competitive firm's output is currently such that its marginal cost is $225 and rising. Its marginal revenue is $210. Assuming profit maximization, this firm should: |

|  | A) | cut its price and increase production |

|  | B) | raise its price and cut production |

|  | C) | cut its price and cut production |

|  | D) | leave price unchanged and cut production |

|

|

|

| 7 |  |

For all values above minimum average variable cost, a competitive firm's: |

|  | A) | supply curve is coincident with its marginal cost curve |

|  | B) | supply curve is coincident with its average total cost curve |

|  | C) | demand curve is coincident with its average total cost curve |

|  | D) | demand curve is coincident with its supply curve |

|

|

|

| 8 |  |

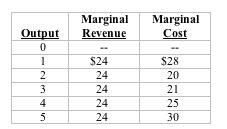

Use the following diagrams to answer the next question.

<a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/1113273090/384258/quiz21c_8.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (6.0K)</a> <a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/1113273090/384258/quiz21c_8.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (6.0K)</a>

Refer to the above diagrams, which pertain to a purely competitive firm and the industry in which it operates. In the long run we should expect: |

|  | A) | new firms to enter, market demand to rise, and price to fall |

|  | B) | demand to increase, and price to rise |

|  | C) | input prices to fall, supply to increase, and price to fall |

|  | D) | exit of some firms, supply to decrease, and price to rise |

|

|

|

| 9 |  |

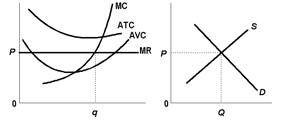

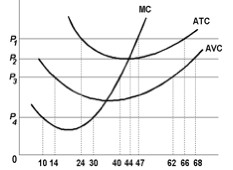

Use the following diagram to answer the next question.

<a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/1113273090/384261/quiz21c_9.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (9.0K)</a> <a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/1113273090/384261/quiz21c_9.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (9.0K)</a>

Which one of the following price-quantity combinations is not on this competitive firm's short-run supply curve? |

|  | A) | P1, 47 |

|  | B) | P2, 44 |

|  | C) | P3, 40 |

|  | D) | P4, 30 |

|

|

|

| 10 |  |

In the long run, competitive markets achieve: |

|  | A) | allocative efficiency because P = min ATC but not productive efficiency because P > min AVC |

|  | B) | allocative efficiency because P = MC and productive efficiency because P = min ATC |

|  | C) | productive efficiency because P = min ATC but not allocative efficiency because P > MR |

|  | D) | neither productive nor allocative efficiency |

|

|