|

| 1 |  |

If the dollar amount of loans paid off exceeds the dollar amount of new loans issued: |

|  | A) | money is destroyed |

|  | B) | the value of money will decrease |

|  | C) | money is created |

|  | D) | there will be no impact on the quantity of money |

|

|

|

| 2 |  |

Suppose a bank has checkable deposits of $1,000,000 and the legal reserve ratio is 5 percent. If the institution has excess reserves of $5,000, then its actual reserves are: |

|  | A) | $45,000 |

|  | B) | $50,000 |

|  | C) | $55,000 |

|  | D) | $5,000 |

|

|

|

| 3 |  |

Assume that SIC, Inc. writes a $50,000 check on its account at Metro National Bank to repay the balance on a loan issued by this bank. As a result of this transaction: |

|  | A) | the money supply declines by $50,000 |

|  | B) | the money supply increases by $50,000 |

|  | C) | the bank's excess reserves will decrease by $50,000 |

|  | D) | the bank's required reserves will increase by $50,000 |

|

|

|

| 4 |  |

A single bank can safely increase its total loans by an amount equal to its: |

|  | A) | required reserves |

|  | B) | total reserves |

|  | C) | excess reserves |

|  | D) | total deposits |

|

|

|

| 5 |  |

The market in which banks borrow reserves from one another overnight is called the: |

|  | A) | prime market |

|  | B) | money market |

|  | C) | short-term market |

|  | D) | Federal funds market |

|

|

|

| 6 |  |

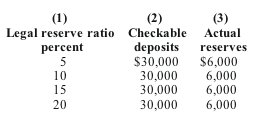

Answer the next question on the basis of the following table for a commercial bank:

<a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0073273082/384258/quiz13a_6.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (8.0K)</a> <a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0073273082/384258/quiz13a_6.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (8.0K)</a>

Refer to the above table. When the legal reserve ratio is 15 percent, the excess reserves of this single bank are: |

|  | A) | $0 |

|  | B) | $1,000 |

|  | C) | $1,500 |

|  | D) | $24,000 |

|

|

|

| 7 |  |

Money is created when: |

|  | A) | loans are repaid |

|  | B) | the net worth of the banking system is increased |

|  | C) | banks acquire physical capital |

|  | D) | banks make additional loans |

|

|

|

| 8 |  |

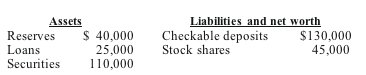

Assume the Continental National Bank's balance statement is as follows:

<a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0073273082/384258/quiz13a_8.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (7.0K)</a> <a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0073273082/384258/quiz13a_8.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (7.0K)</a>

Assume the legal reserve ratio is 10 percent. After a check for $20,000 is drawn and cleared against it, the bank's excess reserves would be: |

|  | A) | $5,000 |

|  | B) | $9,000 |

|  | C) | $29,000 |

|  | D) | $70,000 |

|

|

|

| 9 |  |

In which of the following scenarios is money created? |

|  | A) | Johnson deposits her $2,000 weekly pay check at Morton Bank |

|  | B) | Morton Bank adds to its total reserves held at the Federal Reserve Bank |

|  | C) | Johnson takes out a loan from Morton Bank to purchase a new car |

|  | D) | Johnson repays her car loan |

|

|

|

| 10 |  |

The fractional reserve system of banking: |

|  | A) | requires a strong central bank to administer it |

|  | B) | prevents banks from creating money |

|  | C) | was born when goldsmiths learned that gold receipts were rarely redeemed for gold |

|  | D) | is based on reserve requirements in excess of 100% |

|

|