|

| 1 |  |

Which of the following is not an asset to a commercial bank? |

|  | A) | government securities held by the bank |

|  | B) | loans outstanding |

|  | C) | checkable deposits |

|  | D) | reserves held at the Fed |

|

|

|

| 2 |  |

In order for a bank to increase its lending, it must be the case that: |

|  | A) | actual reserves exceed required reserves |

|  | B) | actual reserves equal required reserves |

|  | C) | required reserves exceed actual reserves |

|  | D) | assets exceed liabilities plus net worth |

|

|

|

| 3 |  |

Hassan deposits $50,000 in a commercial bank that is required to retain 20% in reserve. The deposit increases the lending capacity of the bank by: |

|  | A) | $5,000 |

|  | B) | $10,000 |

|  | C) | $40,000 |

|  | D) | $50,000 |

|

|

|

| 4 |  |

Claire deposits $20,000 in a commercial bank, which then sends the deposit to its account with the regional Federal Reserve Bank. If the reserve requirement is 5%, actual, required, and excess reserves increase by, respectively: |

|  | A) | $20,000, $1,000, and $19,000 |

|  | B) | $20,000, $5,000, and $15,000 |

|  | C) | $20,000, $20,000, and $20,000 |

|  | D) | $1,000, $1,000, and $19,000 |

|

|

|

| 5 |  |

If a bank sells $5,000 of government securities to the Fed, the deposit reserves of the bank would: |

|  | A) | increase by $5,000 |

|  | B) | decrease by $5,000 |

|  | C) | increase by $5,000 times the required reserve ratio |

|  | D) | decrease by $5,000 times the required reserve ratio |

|

|

|

| 6 |  |

Assume the required reserve ratio is 20%. If the commercial banking system has $20 million in excess reserves, the banking system could potentially create: |

|  | A) | $20 million in new money |

|  | B) | $100 million in new money |

|  | C) | $120 million in new money |

|  | D) | $200 million in new money |

|

|

|

| 7 |  |

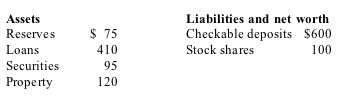

Answer the next question based on the following information for the commercial banking system. All figures are in billions of dollars.

<a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0073273082/384258/quiz13c_7.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (6.0K)</a> <a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0073273082/384258/quiz13c_7.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (6.0K)</a>

Refer to the above data. If the reserve ratio is 10%, the commercial banking system has excess reserves of: |

|  | A) | $0 |

|  | B) | $5 billion |

|  | C) | $15 billion |

|  | D) | $40 billion |

|

|

|

| 8 |  |

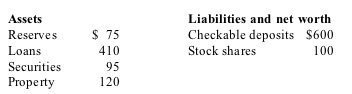

Answer the next question based on the following information for the commercial banking system. All figures are in billions of dollars.

<a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0073273082/384258/quiz13c_8.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (6.0K)</a> <a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0073273082/384258/quiz13c_8.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (6.0K)</a>

Refer to the above data. If the reserve ratio is 10%, the maximum amount by which the commercial banking system can expand the money supply is: |

|  | A) | $15 billion |

|  | B) | $50 billion |

|  | C) | $60 billion |

|  | D) | $150 billion |

|

|

|

| 9 |  |

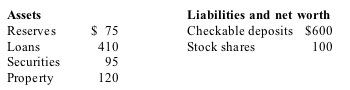

Answer the next question based on the following information for the commercial banking system. All figures are in billions of dollars.

<a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0073273082/384258/quiz13c_9.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (8.0K)</a> <a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0073273082/384258/quiz13c_9.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (8.0K)</a>

Refer to the above data. If the banking system currently has exactly no excess reserves, what is the value of the monetary multiplier? |

|  | A) | 5 |

|  | B) | 8 |

|  | C) | 10 |

|  | D) | 12 |

|

|

|

| 10 |  |

Early goldsmiths were vulnerable to "runs" or "panics" because they: |

|  | A) | could not accurately assay or measure the gold deposits of their customers |

|  | B) | kept all their gold deposits at other locations for safety |

|  | C) | issued loans by giving borrowers paper money in excess of the deposits they held at the bank |

|  | D) | destroyed money when making loans |

|

|