|

| 1 |  |

If the money multiplier is 1, the required reserve ratio must be: |

|  | A) | greater than 100% |

|  | B) | 100% |

|  | C) | less than 100% |

|  | D) | zero |

|

|

|

| 2 |  |

Answer the next question on the basis of the following information: the required reserve ratio is 10%; the system initially has no excess reserves; $20 billion in new currency is deposited into the system. The $20 billion in new deposits will initially create excess reserves of: |

|  | A) | $2 billion |

|  | B) | $18 billion |

|  | C) | $20 billion |

|  | D) | $200 billion |

|

|

|

| 3 |  |

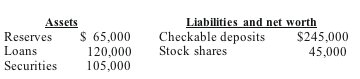

Assume the Continental National Bank's balance statement is as follows:

<a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0073273082/384258/quiz13b_3.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (7.0K)</a> <a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0073273082/384258/quiz13b_3.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (7.0K)</a>

Assuming a legal reserve ratio of 20 percent, how much excess reserves would this bank have after a check for $15,000 is drawn and cleared against it? |

|  | A) | $2,000 |

|  | B) | $4,000 |

|  | C) | $12,000 |

|  | D) | $19,000 |

|

|

|

| 4 |  |

Sam draws a $100 check on his account at Bank A which is then deposited in Bank B. When this check is cleared: |

|  | A) | neither Bank A's nor Bank B's deposits or reserves are affected |

|  | B) | Bank A gains reserves equal to $100 and Bank B gains deposits equal to $100 |

|  | C) | Bank A loses reserves and deposits equal to $100 |

|  | D) | Bank B loses reserves and deposits equal to $100 |

|

|

|

| 5 |  |

The supply of money is increased whenever banks increase their excess reserves. |

|  | A) | True |

|  | B) | False |

|

|

|

| 6 |  |

Assume the banking system has no excess reserves with a reserve requirement of 20%. The reserve requirement is then dropped to 10%. As a result of this reduction: |

|  | A) | the money multiplier will decrease |

|  | B) | bank profitability will likely decrease |

|  | C) | banks will be forced to accumulate reserves by reducing their lending activity |

|  | D) | the money supply will likely increase |

|

|

|

| 7 |  |

A bank temporarily short of required reserves may remedy the situation by borrowing reserves: |

|  | A) | in the bond market |

|  | B) | in the Federal deposit market |

|  | C) | from its own depositors |

|  | D) | in the Federal funds market |

|

|

|

| 8 |  |

Commercial bank reserves are an asset both to commercial banks and to the Federal Reserve Bank holding them. |

|  | A) | True |

|  | B) | False |

|

|

|

| 9 |  |

The monetary multiplier is equal to: |

|  | A) | one |

|  | B) | the inverse of actual reserves minus required reserves |

|  | C) | the inverse of one minus the required reserve ratio |

|  | D) | the inverse of the required reserve ratio |

|

|

|

| 10 |  |

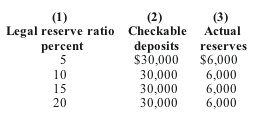

Answer the next question on the basis of the following table for a commercial bank:

<a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0073273082/384258/quiz13b_10.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (8.0K)</a> <a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0073273082/384258/quiz13b_10.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (8.0K)</a>

Refer to the above table. When the legal reserve ratio is 10 percent, the excess reserves of this single bank are: |

|  | A) | $0 |

|  | B) | $1,500 |

|  | C) | $3,000 |

|  | D) | $18,000 |

|

|