|

| 1 |  |

Suppose Ole and Lena each own a tradable quota that allows them to catch 1000 tons of salmon for this year. Each owns a boat with a capacity of 2000 tons, but Lena's fishing cost is $2000 per ton while Ole's cost is $1800 per ton. If the market price of salmon is expected to be $2200 per ton and tradable quotas are currently priced at $250 per ton: |

|  | A) | Lena will increase her profits by selling her quota to Ole |

|  | B) | Ole will increase his profits by selling his quota to Lena |

|  | C) | Both Lena and Ole would like to sell their quotas on the open market |

|  | D) | Both Lena and Ole would like to buy an additional 1000-ton quota on the open market |

|

|

|

| 2 |  |

In 2004, approximately what percentage of U.S. electricity was generated by coal-fired plants? |

|  | A) | 6% |

|  | B) | 20% |

|  | C) | 50% |

|  | D) | 70% |

|

|

|

| 3 |  |

Suppose you own an oil well that has proven reserves of 100 barrels. By selling the oil today, you could get net benefits of $70 per barrel. Alternatively, you could wait for one year and get net benefits at that time of $75 per barrel. If the interest rate is 5%, you should: |

|  | A) | pump the oil today, since $70 could be invested and eventually return more than $75 |

|  | B) | pump the oil next year, since $75 is more than $70 |

|  | C) | pump the oil next year, since $70 is less than the present value of $75 received next year |

|  | D) | pump the oil today, since $70 exceeds the present value of $75 received next year |

|

|

|

| 4 |  |

Contrary to the predictions of Thomas Malthus in his 1798 essay An Essay on the Principle of Population, evidence actually shows that: |

|  | A) | higher living standards are associated with higher birth rates |

|  | B) | higher living standards are associated with lower birth rates |

|  | C) | total fertility rates have consistently risen for all but the very poorest countries |

|  | D) | the majority of the world's population now lives in countries whose birthrates are in excess of the replacement rate |

|

|

|

| 5 |  |

The optimal management of resources primarily requires comparing: |

|  | A) | the net benefits of using the resource now versus the net benefits of using it later |

|  | B) | current consumption benefits versus future costs of extraction |

|  | C) | the present value of benefits received versus current costs of extraction |

|  | D) | the net benefits of using the resource now versus the present value of extraction costs |

|

|

|

| 6 |  |

In his 1968 book, The Population Bomb, Paul Erlich predicted that millions of people would starve to death in subsequent decades. His predictions: |

|  | A) | came true, as evidenced by the famines in Africa in the 1980s |

|  | B) | failed to materialize because of a massive effort to relieve famine by the United Nations and other global non-government organizations |

|  | C) | failed to materialize because the supply of productive resources has increased faster than the demand for those resources |

|  | D) | failed to materialize because rising commodity prices encouraged the production of more resources |

|

|

|

| 7 |  |

Per capita U.S. consumption of solids—plastics, metals, and the like—has: |

|  | A) | increased since 1990, as measured by the extraction rates of ore and crude oil |

|  | B) | increased since 1990, as measured by the increase in real GDP |

|  | C) | decreased since 1990, as measured by the commodity price index |

|  | D) | leveled off since 1990, as measured by per capita trash generation |

|

|

|

| 8 |  |

The overall supply of oil is upward sloping because: |

|  | A) | some sources of oil, such as biodiesel, are more costly than other sources, such as tar sands. |

|  | B) | the higher the price of oil, the lower the amount demanded |

|  | C) | increases in the price of oil increase the supply of oil |

|  | D) | oil exporting countries regulate the price of oil to match consumer willingness to pay |

|

|

|

| 9 |  |

Which of the following best exemplifies a non-renewable resource? |

|  | A) | A national forest |

|  | B) | Pacific halibut |

|  | C) | Western coal |

|  | D) | A local aquifer |

|

|

|

| 10 |  |

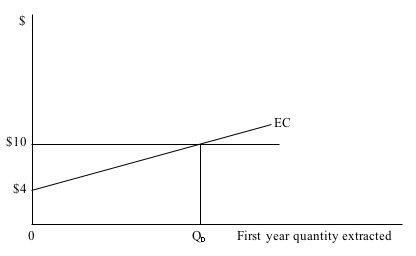

Refer to the following:

<a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/1113273090/384260/quiz27weba_10.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (0.0K)</a> <a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/1113273090/384260/quiz27weba_10.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (0.0K)</a>

Suppose you own a source of a non-renewable resource. The line labeled EC above illustrates the cost of extracting the resource. If the current market price of the resource is $10 and is expected to rise, you should: |

|  | A) | sell Q0 units of the resource |

|  | B) | sell less than Q0 units of the resource, because EC ignores the lost profits from leaving the resource in the ground |

|  | C) | sell more than Q0 units of the resource, because EC ignores the lost profits from leaving the resource in the ground |

|  | D) | sell none of the resource, because the cost of extraction eventually exceeds the selling price |

|

|